|

|

Looking at your investment performance

03-10-2017, 11:23 AM

03-10-2017, 11:23 AM

|

#1

|

|

Dryer sheet wannabe

Join Date: Feb 2017

Posts: 24

|

Looking at your investment performance

Well, after some dilly-dallying, decided that it is time to take the plunge to BUY AND HOLD in a diversified mix of stocks and bonds, even though all of my emotions are saying:

A. This market is frothy

B. Cannot trust the market because it is "rigged" (a lot of ppl have this notion and it is hard to ignore, given the existence of computer algorithms for trading stocks, central banks and such)

C. May be investing at or near the "top" (if such exists)

D. Bonds have been performing crappily

E. Upcoming rate hike decision, european elections, mkts, debt ceiling bla bla

Currently have about 65% of funds in a money market account and 35% in an IRA that invests in both US and int'l stocks + bonds.

I really want to put the 65% to work (thanks all for the help before in deciding a good mix of stock + bond funds), but what is stopping me ATM is a strong tendency to pull out of the market when things get rough.

I DO NOT want to look at my investment performance but feel on guard with the current climate, toppiness of the market + volatility -- I NEED to rebalance if needed or take advantage of a market plunge by adding more cash, say.

But if I look at my investments at all, I will freak out!

How do you guys keep from market timing or panicking when things go south?

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

03-10-2017, 11:29 AM

03-10-2017, 11:29 AM

|

#2

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2016

Location: Acworth

Posts: 1,214

|

Quote: Quote:

|

How do you guys keep from market timing or panicking when things go south?

|

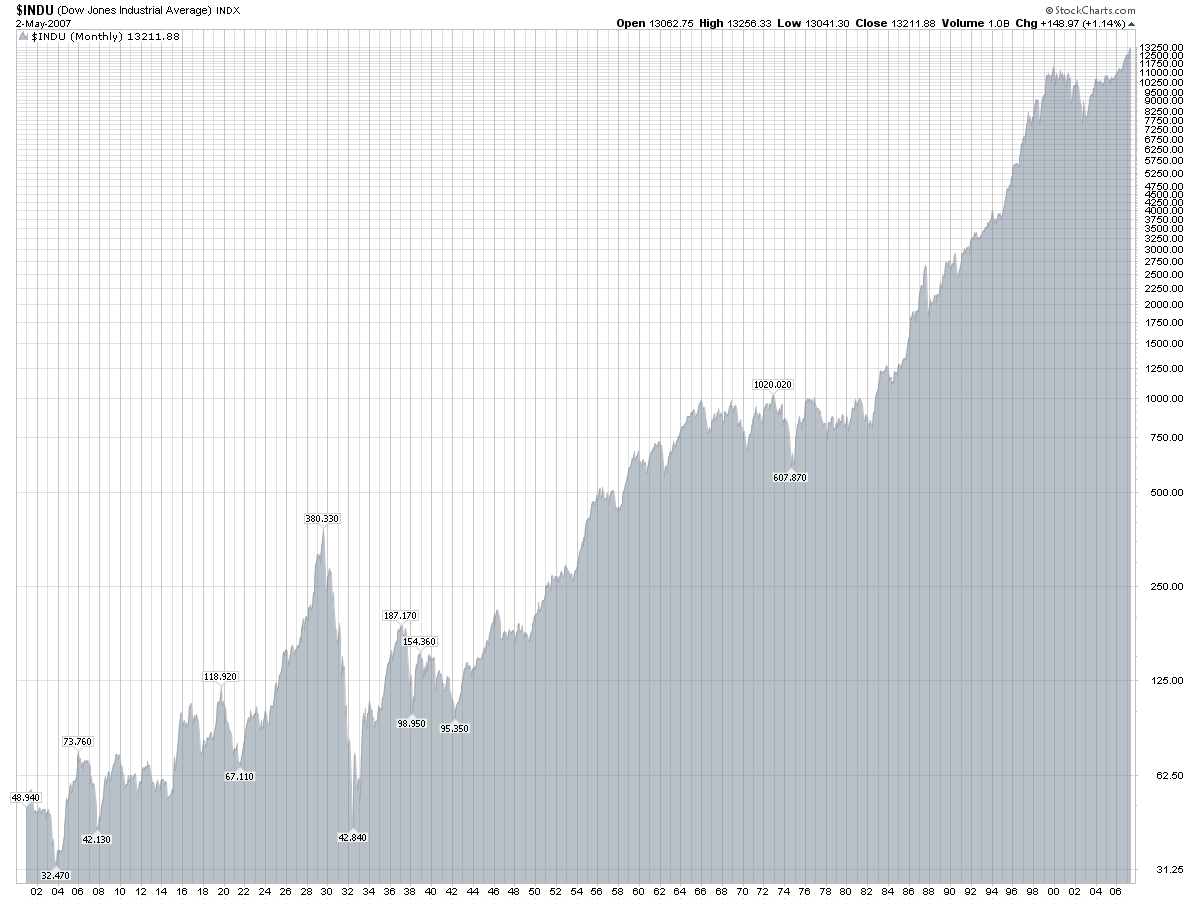

I look at this (or similar):

and remind myself that for the entire history of our markets, what goes down has always come up and there is no reason to think that is going to change anytime soon.

I also then remind myself that if the market drops it's probably a great time to buy as the best returns are generally those made from money put in when the market dropped. So then I see if I have some extra money I can buy into the market with

|

|

|

03-10-2017, 01:13 PM

03-10-2017, 01:13 PM

|

#3

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2015

Location: Michigan

Posts: 5,003

|

I invite you to read Your Money and Your Brain by Jason Zweig.

__________________

"The mountains are calling, and I must go." John Muir

|

|

|

03-10-2017, 02:01 PM

03-10-2017, 02:01 PM

|

#4

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2016

Posts: 8,968

|

I pay my FA to do that. He buys and sells on whatever research the firm does. I don't even look at it.

Well I look at the monthly statements when they come in and I look at the trade confirmations when they come in.

I'm not on the phone with him second guessing whatever he's doing and he's not on the phone with me pitching this or that.

|

|

|

03-10-2017, 02:05 PM

03-10-2017, 02:05 PM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2005

Posts: 10,252

|

Quote: Quote:

|

How do you guys keep from market timing or panicking when things go south?

|

I have a written rule that says I absolutely MUST buy equities when things go south.

I only sell things when a particular asset class exceeds the percentage I have earmarked for it. That's written, too.

Yep, read those behavioral finance books such as the Zweig book already mentioned.

And as for market timing, I like to follow LOL!'s Market Timing Newsletter because it is the best and spot on most of the time. Plus it doesn't cost anything to subscribe to it.

|

|

|

03-10-2017, 02:14 PM

03-10-2017, 02:14 PM

|

#6

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,363

|

Quote: Quote:

Originally Posted by hgm735

....How do you guys keep from market timing or panicking when things go south?

|

I've been investing since the late 1970s so have seen a lot of up and downs and ups.... your AA and rebalancing are sort of like "The Force"... you just need to believe in it.

In your case, I would value average in over 18-24 months and then rebalance as needed, but at least annually.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

03-12-2017, 06:23 AM

03-12-2017, 06:23 AM

|

#7

|

|

Recycles dryer sheets

Join Date: Feb 2017

Posts: 180

|

I put our money in Wellesley Income Fund(VWINX) it's been around since 1970. I looked at it in all kinds of markets including the 1970's when bond yields were rising, it did well. I get professional management, a good rate of return and I no longer worry about our money. Peace of mind is worth something, kind of like paying off your mortgage.

|

|

|

03-12-2017, 06:35 AM

03-12-2017, 06:35 AM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by hgm735

But if I look at my investments at all, I will freak out!

How do you guys keep from market timing or panicking when things go south?

|

If you freak out, then it's better not too look.

There's bad market timing, and then there's good market timing.

I try to be somewhat of a contrarian. When people jump up and down with joy, I remind myself that good times do not last forever. When people cry and grit their teeth, I tell myself that things are not really that bad, and it too shall pass.

So, I do try to buy low/sell high by watching different sectors. But as I can never be sure of anything, I never go all in or all out, and stay quite diversified.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

03-12-2017, 07:07 AM

03-12-2017, 07:07 AM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,140

|

I find that if I'm already invested, I stay invested. And, yes, I am able to buy more equities after things go south. It's called rebalancing.

What I find impossible is to add new funds when things seem very high.

__________________

Retired since summer 1999.

|

|

|

03-12-2017, 07:08 AM

03-12-2017, 07:08 AM

|

#10

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2009

Location: Alberta/Ontario/ Arizona

Posts: 3,393

|

Takes experience to not "freak out". I look at my portfolio several times a day, but stay cool. Didn't trade at all last year.

|

|

|

03-12-2017, 07:32 AM

03-12-2017, 07:32 AM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,719

|

Quote: Quote:

Originally Posted by hgm735

How do you guys keep from market timing or panicking when things go south?

|

I look at this long-range graph from time to time. Have been doing so for more than ten years. Here is the 2016 version:

https://public.dreyfus.com/documents...s/skyandex.pdf

|

|

|

03-12-2017, 03:37 PM

03-12-2017, 03:37 PM

|

#12

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2006

Location: Pacific latitude 20/49

Posts: 7,677

|

I look at it every day because I want to savour the moment. It may not happen again for a while.

__________________

For the fun of it...Keith

|

|

|

03-13-2017, 08:36 AM

03-13-2017, 08:36 AM

|

#13

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2009

Location: Alberta/Ontario/ Arizona

Posts: 3,393

|

My largest position took a big hit last week. My dollar loss was close to 7 figures. Back up today. I take it all in stride.

|

|

|

03-14-2017, 05:45 AM

03-14-2017, 05:45 AM

|

#14

|

|

Full time employment: Posting here.

Join Date: May 2007

Posts: 883

|

Quote: Quote:

Originally Posted by hgm735

How do you guys keep from market timing or panicking when things go south?

|

Experience a.k.a old guy.

__________________

"It is better to have a permanent income than to be fascinating". Oscar Wilde

|

|

|

03-14-2017, 06:06 AM

03-14-2017, 06:06 AM

|

#15

|

|

Administrator

Join Date: Apr 2006

Posts: 23,037

|

I have mastered the art of doing nothing. I chose an asset allocation long ago. Since then, when I get my paycheck every two weeks, I buy more assets (mostly balanced domestic funds, international index funds, and REIT index funds). I do this rain or shine, in up and down markets. And I rely on the graph posted by exnavynuke. In early 2009, I was down over 50% from my 2007 portfolio peak. Now I have over twice what I did at that 2007 peak. When I retire in about two years, I won't be buying more, but I think I'll continue to do nothing.

__________________

Living an analog life in the Digital Age.

|

|

|

03-14-2017, 09:54 AM

03-14-2017, 09:54 AM

|

#16

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2012

Location: Texas

Posts: 3,024

|

Quote: Quote:

Originally Posted by hgm735

... Currently have about 65% of funds in a money market account ... I really want to put the 65% to work ...

|

I'd be extremely hesitant about dumping it into the market right now. I'd either DCA very slowly or wait for some opportunistic dips, or maybe both.

Quote: Quote:

Originally Posted by hgm735

... How do you guys keep from market timing or panicking when things go south?

|

I had some market timing tendencies when I was working, with mixed results overall but generally positive. It wasn't from panicking though; usually a technical indicator and/or gut feel that a secular trend was at or near an end. And it was never all or nothing... more like 90/10 to 60/40 or vice versa.

I'm coming up on 4 years of ER, but it's been mostly smooth sailing. Not exactly sure how I'll react in a 20%+ market drop, or if I get that strong feeling about an inflection point. The plan is to stay the course and rebalance. But I would never categorically rule out another timing move if that's how I read the tea leaves.

However, we also structured things to reduce our overall reliance on portfolio withdrawals. For example, we both elected the annuity option rather than lump sum on our small pensions, and we both started collecting immediately. We also paid off the mortgage, bought two rental houses, and loaded up the taxable account with dividend-heavy ETFs like VYM. Deep down, I'll still be a little panicky; I think that's normal. But hopefully the steady cash coming in will offset some of the old instincts.

__________________

Retired at 52 in July 2013. On to better things...

AA: 85/15 WR: 2.7% SI: 2 pensions, SS later

|

|

|

03-15-2017, 11:41 PM

03-15-2017, 11:41 PM

|

#17

|

|

Dryer sheet wannabe

Join Date: Feb 2017

Posts: 24

|

Well, I veered a bit off course from the excellent advice here - but I'm hoping that I learned from my mistakes!

Woke up this morning. An event having nothing to do with stocks shook me to the core. No excuses, but the urge to gamble came, and that came with today's anticipated rate hike and my inexperienced brain saying "put $$ in VFH and JDST", easy bucks! Didn't work out that way. Lost about $1500 and THEN decided, that's it, time to really, seriously invest. So I put a little over $200K in VTI and about $40K in BND. Have decided that as an idiot who doesn't listen to good advice the first time, it's time to bite the bullet and buy and hold this. (I still have about $160K in cash still)

Breakdown (liquid investment totalling $400,000):

$200,000 - VTI

$40,000 - BND

$160,000 - cash

In addition to the above, have investments (annuities and such):

$270,000 (not as liquid), comprised of:

80% US and Int'l stocks

7% emerging mkts

12% bonds

1% REIT

I know I should have value averaged this but the $1500 loss was so upsetting to me that I just lump summed the VTI and BND. Also trying to be tax efficient here (in 25% bracket).

Should I just leave the above allocation as is, for now, or should I change it? (I need approx. $760 a month in investment income + the fixed income I have already to meet expenses) Total assets are about $700K, give or take.

Main goal is not to outlive my money. Ideally, I would like to not touch principle. Have at least 40 + years to live but only spend about $35K a year. Although I mentally calculate that I will be spending A LOT more on healthcare as the years go on.

|

|

|

03-15-2017, 11:54 PM

03-15-2017, 11:54 PM

|

#18

|

|

Dryer sheet wannabe

Join Date: Feb 2017

Posts: 24

|

P.S. Also aware that I added VTI and BND when valuations are quite high, though I don't know if we're near a market top or not.

Does anyone have any historical charts or data on how investors fare when they jump into the market right before a major crash with a stocks + bonds mix?

|

|

|

03-16-2017, 12:08 AM

03-16-2017, 12:08 AM

|

#19

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by hgm735

Does anyone have any historical charts or data on how investors fare when they jump into the market right before a major crash?

|

Schwab's most recent newsletter has a chart showing how one fares at this point if he

1) Jumped in at a market bottom and stayed invested till now

2) Jumped in at a market top and stayed

3) Stayed in T-bill

They went back to the early 90s, and option 1 is of course the best, and option 3 is always last. I will see if I can provide a link to the chart.

Of course people move money around or do rebalancing or what not. So, they could do better than #1, or worse than #3.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

03-16-2017, 02:12 AM

03-16-2017, 02:12 AM

|

#20

|

|

Recycles dryer sheets

Join Date: Feb 2017

Posts: 180

|

Quote: Quote:

Originally Posted by NW-Bound

Schwab's most recent newsletter has a chart showing how one fares at this point if he

1) Jumped in at a market bottom and stayed invested till now

2) Jumped in at a market top and stayed

3) Stayed in T-bill

They went back to the early 90s, and option 1 is of course the best, and option 3 is always last. I will see if I can provide a link to the chart.

Of course people move money around or do rebalancing or what not. So, they could do better than #1, or worse than #3.

|

It all depends on your time horizon. Since mine is shorter now at 55 than it was at 20 when I first started investing, I'll take door number one. Honestly though, I bought $180,000 of Wellesley Income Fund on Monday. I'm not concerned about growth as much as the income.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|