I read this article with interest:

https://www.fidelity.com/viewpoints/retirement/tax-savvy-withdrawals

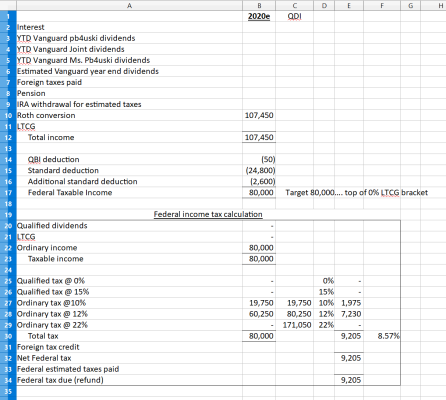

So I'm looking for a calculator that will help me determine how to withdraw my funds from my various accounts (401K, IRA, Roth, Taxable etc.) in the most tax efficient way, including doing Roth conversions.

Anyone know of a simple to use calculator that would handle those 2 issues?

https://www.fidelity.com/viewpoints/retirement/tax-savvy-withdrawals

So I'm looking for a calculator that will help me determine how to withdraw my funds from my various accounts (401K, IRA, Roth, Taxable etc.) in the most tax efficient way, including doing Roth conversions.

Anyone know of a simple to use calculator that would handle those 2 issues?