pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

.... My question is really this: At age 57, with AA of 70% stock, 30% bonds, what are the pros/cons of buying individual dividend stocks instead of buying bonds? Based on my current spend, I should not need to sell the new stocks any time soon. So even if they lose value for 10 years, it shouldn't matter since I will have the income from them coming in.

Even dividend stocks are stocks... so if you substitute dividend stocks for bonds you are effectively increasing your AA above 70/30 to higher stock allocation.

Now, given your situation where your regular spending is already covered by pensions and passive income it probably doesn't matter much and would be perfectly safe to increase your AA above 70/30... but don't fool youself that dividend stocks are bonds... if we have a recession the values of dividends stocks and bonds will behave very differently.

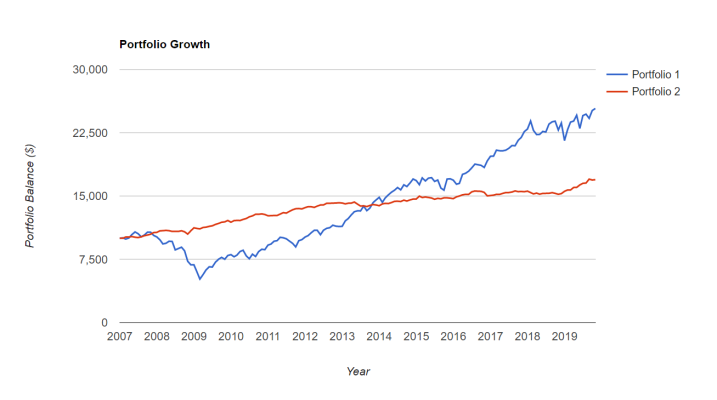

Blue line is Vanguard High Dividend Yield Index Inv and red line is Vanguard Total Bond Market Index Inv. See the difference?

Attachments

Last edited: