nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

Not trying to scare you, but with such a large discrepancy in lump sum and monthly payout options, I would be doing a little more homework before making this decision. 'If something sounds too good to be true, it probably is.' It's an important one you'll be living with for 30+ years.

Is Your Pension Still Safe?

How Safe Is Your Pension Plan - Consumer Reports

http://www.dol.gov/ebsa/newsroom/fsbankruptcy.html

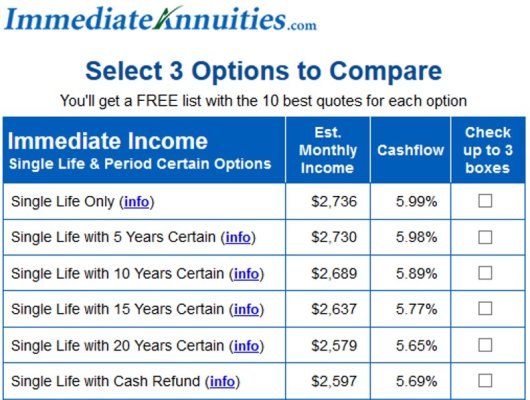

Yes the numbers on this pension look very strange and lob sided, that's why I'm curious who runs it, also whether there is something like very long service that might be biasing the pension.....but that should also be reflected in the lump sum amount....7.9% interest rate for age 57 is very high.

Of course the funding issue with pensions comes about because of failures of companies and the public sector to live up to the contracts and promises they have made. Bizarrely it is usually the pensioners that suffer through reduced benefits rather than the administrators for failing to fund or run the pensions correctly. It's another case of punishing the victims rather than the criminals.