Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

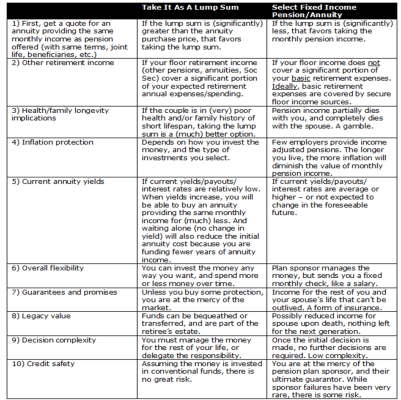

Understandably, this question comes up often - but the answer is usually not nearly as simple as some replies suggest. So I've been meaning to provide a quick summary for later reference here and elsewhere.

I attempted to put them in some logical order, but other than #1, what's most important will vary for each individual. And there are undoubtedly other considerations as well, I quit at 10.

Though inflation is mentioned, the summary is only meant to deal with fixed income annuities vs pensions, as most (at least private sector) are not COLA'd.

I'd welcome any proofreading or other input/suggestions.

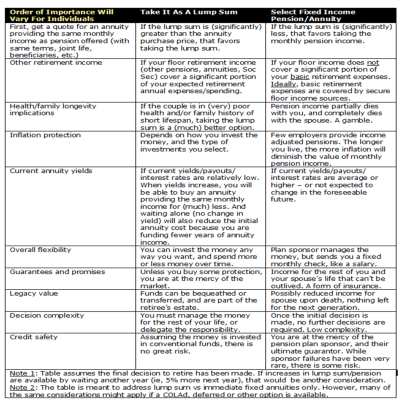

I attempted to put them in some logical order, but other than #1, what's most important will vary for each individual. And there are undoubtedly other considerations as well, I quit at 10.

Though inflation is mentioned, the summary is only meant to deal with fixed income annuities vs pensions, as most (at least private sector) are not COLA'd.

I'd welcome any proofreading or other input/suggestions.