C

Cut-Throat

Guest

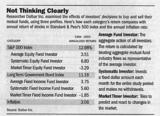

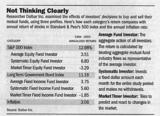

Another article in the paper today regarding Market Timing. Posted this chart that I thought was interesting. From the period 1984-2000.

We're all smarter than those chumps. Right? - Well not me and maybe not Unclemick.

We're all smarter than those chumps. Right? - Well not me and maybe not Unclemick.