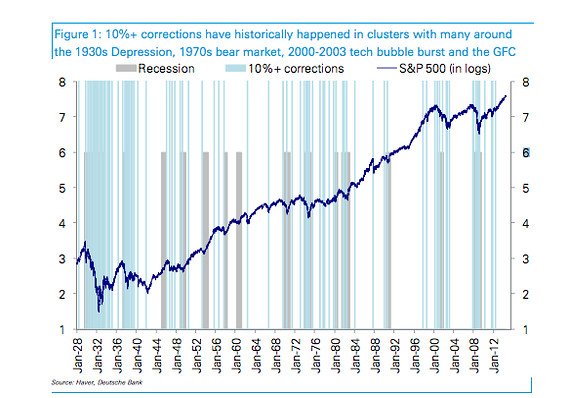

Chadha says big corrections are unusual mid-cycle, which is where he reckons we are right now. Instead, three-fourths of such corrections happen near recessions (measured as one year on either side) — and almost never occur when the trend in the unemployment rate is down, Chadha writes.

Chadha also downplays the scope of the current rally when stacked up versus other mid-cycle runs. While the average rally between corrections has been 43% over 1 1/2 years, Chadha says the averages are skewed by short rallies interrupted by frequent corrections around crises and recessions. A better comparison are the “long business cycles” of the 1960s, 1980s, 1990s and 2000s, he says, when the stock-market rallies averaged 110% and lasted four years.