Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

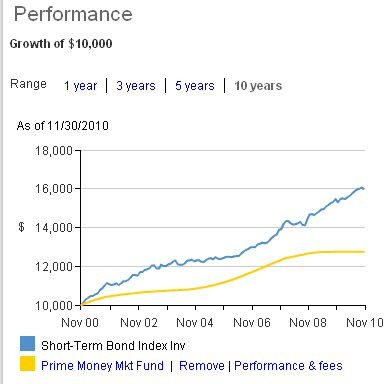

My "cash" holdings are all in VMMXX. I've finally gotten tired of the extremely low returns and I'm looking for alternatives. My bank has CD's, would be a real PITA, and the rates aren't much better than VMMXX.

I am comfortable with my knowledge re: stocks/funds and bond/funds but I've never had to think much about cash holdings. Are there better alternatives for cash, or an asset class between cash and bonds that I'm overlooking? Didn't see anything on the Vanguard site.

Did a search on Money Market and VMMXX and didn't find much...

I am comfortable with my knowledge re: stocks/funds and bond/funds but I've never had to think much about cash holdings. Are there better alternatives for cash, or an asset class between cash and bonds that I'm overlooking? Didn't see anything on the Vanguard site.

Did a search on Money Market and VMMXX and didn't find much...