REWahoo

Give me a museum and I'll fill it. (Picasso) Give

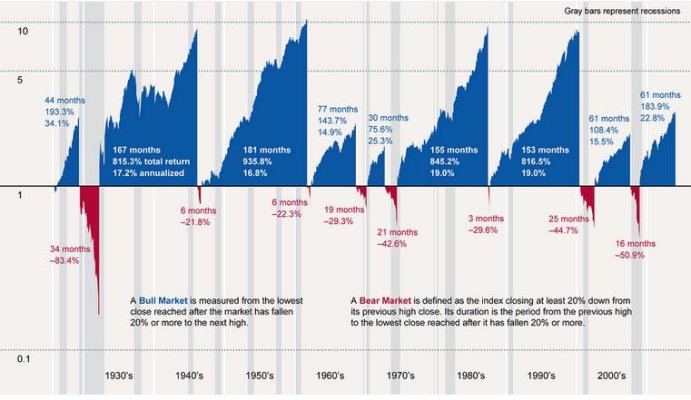

This chart may make you less worried about U.S. stocksBearish calls ... might make you worried about the U.S. stock market, which is more than five years into its bull run that began March 2009.

But a chart created by Morningstar Inc., the Chicago-based investment research firm, shows bull markets often have lasted for more than five years.

My razor-sharp analytical skills immediately focused on the fact there is a lot more blue than red...