Here is the part that I'd worry about. If you convince him to take the lump sum and invest it, what will be his reaction when the markets tank? Especially worrisome if he freaks out and sells at the bottom. At least a pension is guaranteed and you get a fresh chance to blow it every month.

No good deed goes unpunished.

I retire within 1 month of 1 co-worker. He lives with his parents, never married , no kids. (parents transfer everything to him, about 2.5 million including the house, so they can get home based medicaid, but thats another story).

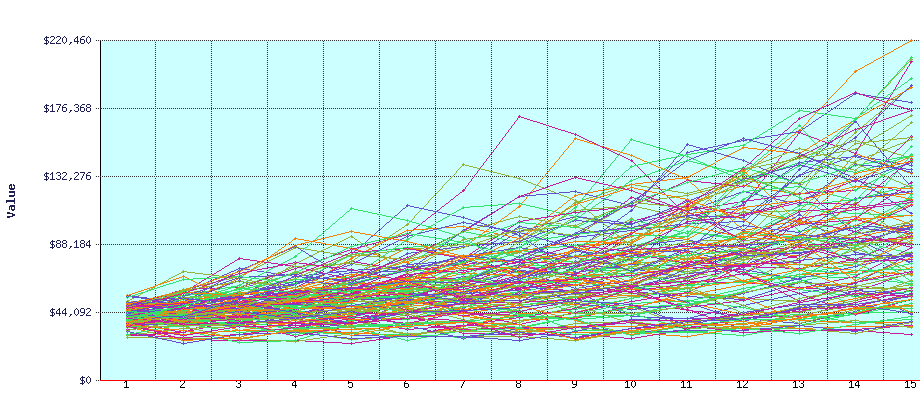

He says to me are you taking the lump sum or the full pension . I told him Lump sum, and a reduced pension, he said I will too. I warned him that if he blows the money he will be upset, he said no . Ill invest it like you do. I told him things look bad, but we need to jump in when we get the checks we only have 60 days to put the money to work. PS this is January 2009. We do the dump and pray method, things turned around. he is sitting on a nice piece of change. Infinitely better than taking the full pension. Guy loves me, calls me every few months, asks how mom is, how is the bride, all pleasant stuff.

Another coworker also retires , he also takes the reduced pension, and takes the lump sum, I give him the same warning , "I think in the long run we will be better off taking the dough, and investing it till we need the money". "But we might wind up being security guards at the hospital checking room passes.

He does not invest it with the cities 457 special roll over account like we did. He bought something his wife's cousin was selling. IDK what it was , because he didn't either, annuity?, SP500?, bonds?, swamp land in Florida? Yeah you know how it went , things went down, they sold(SOLD!), paid taxes and have a big fat zero in the account. All gone and now every month they get about 1000 a month less. I dont think he is actively hunting me down because he veered off the plan, but I still feel horrible about it.