Bestwifeever

Moderator Emeritus

- Joined

- Sep 17, 2007

- Messages

- 17,774

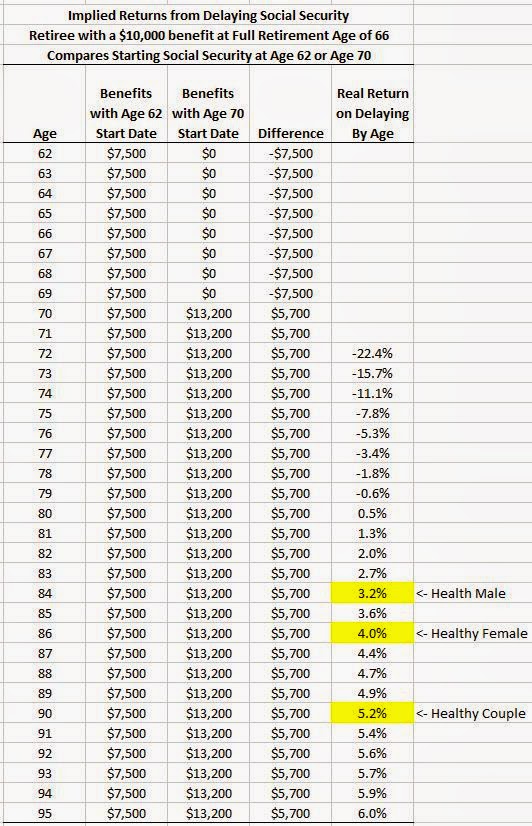

It's not funny -- it's reality. My plan is age 70 at which payment would be 3,551 a month based on the current law but could change if the law changes or the health of SS deteriorates.

"Ironic" was the word I should have used vs "funny" (which I intended as ironic, not hah hah).