brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

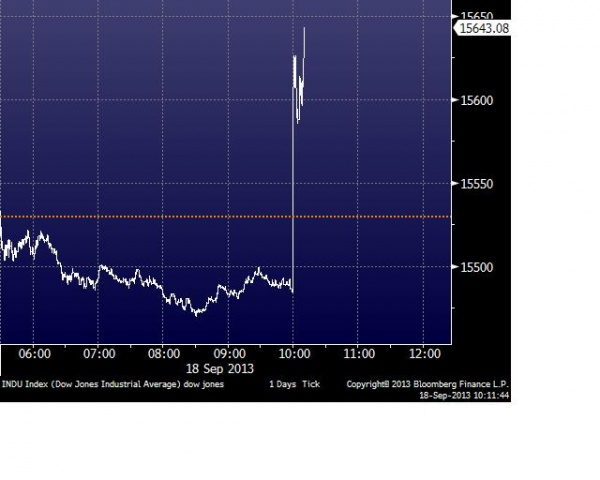

Did not see that one coming and I suspect that the market did not either. Must be chaos anywhere trading is done in pretty much anything.

but not sure where it was after 2:30. I have gotten clobbered on Vg TIPS MF and should have gotten out a month or 2 ago. I want to up the AA to equities but with the S&P 500 and the DJIA at all time highs, again at 2:30 not sure where they closed, it just makes no sense to buy equity MFs now despite the fact so many say the market is a buy as it's under valued. Same ones that thought the taper was in today too! A 7-10% pull back would be great but they buy at any drop so there may be none. We've had only 2 5% drops and the markets have got straight up since last November.

but not sure where it was after 2:30. I have gotten clobbered on Vg TIPS MF and should have gotten out a month or 2 ago. I want to up the AA to equities but with the S&P 500 and the DJIA at all time highs, again at 2:30 not sure where they closed, it just makes no sense to buy equity MFs now despite the fact so many say the market is a buy as it's under valued. Same ones that thought the taper was in today too! A 7-10% pull back would be great but they buy at any drop so there may be none. We've had only 2 5% drops and the markets have got straight up since last November.