Can someone explain the very basics of Obamacare to me? I assume if you have HI thru your employer, you don't have to worry about it? Will you still be able to get HI thru places like eheathinsurance.com? Is Obamacare only for people who dont have access to HI or what? I really have no idea.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Obamacare basics

- Thread starter utrecht

- Start date

- Status

- Not open for further replies.

Silver

Full time employment: Posting here.

There have been several previous threads discussing the Affordable Care Act as we currently know it. Doing a topic search or scanning threads under the "Health and Early Retirement" forum may help.

One of the most helpful links, IMO, was this one.

FAQ: Everything you need to know about Obamacare’s coverage options, in one post

One of the most helpful links, IMO, was this one.

FAQ: Everything you need to know about Obamacare’s coverage options, in one post

Jake46

Recycles dryer sheets

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Answering your specific questions as best as I can...

Generally speaking, yes. There are standards that the plan must satisfy, though.I assume if you have HI thru your employer, you don't have to worry about it?

The ACA will actually begin interfacing with such resellers soon, here in Massachusetts.Will you still be able to get HI thru places like eheathinsurance.com?

ACA is a comprehensive program. It has impacts on most everyone, though not necessarily obvious ones, and for many people, those impacts are merely solidifying that which was already the case - codifying some general practice.Is Obamacare only for people who dont have access to HI or what?

FIRE'd@51

Thinks s/he gets paid by the post

- Joined

- Aug 28, 2006

- Messages

- 2,433

I assume if you have HI thru your employer, you don't have to worry about it?

Not necessarily. Your employer may decide to stop providing employee health insurance and dump its members on the exchange as the City of Chicago is now doing.

I've seen this written elsewhere on the forum but can't find a source. Do you have a link or info source to this?Not necessarily. Your employer may decide to stop providing employee health insurance and dump its members on the exchange as the City of Chicago is now doing.

obgyn65

Thinks s/he gets paid by the post

I've seen this written elsewhere on the forum but can't find a source. Do you have a link or info source to this?

http://www.suntimes.com/news/otherv...irees-may-not-need-city-health-insurance.html

That's not what the link you provided said.Not necessarily. Your employer may decide to stop providing employee health insurance and dump its members on the exchange as the City of Chicago is now doing.

"The most promising proposal — and surely its most controversial — would end the city’s comprehensive retiree health-insurance plan, which primarily covers retirees under age 65...

"The results suggest that 14 percent to 58 percent of affected retirees will pay less if the city terminates the current plan, with the lower figure assuming retirees have substantial non-pension income, and the upper figure assuming city pensions are retirees’ sole source of income."

That's not to say that there aren't other entities who will transfer the burden of covering employee health care onto ACA; I would hope that all companies where the cost to the employee would be higher with their in-house health insurance approach would do so.

Last edited:

Oby, thanks for the link. As bUU pointed out, that news item is a proposal, and affects retired, not current, employees.

FIRE'd@51

Thinks s/he gets paid by the post

- Joined

- Aug 28, 2006

- Messages

- 2,433

That's not what the link you provided said.

Actually, obgyn provided the link - not me.

obgyn65

Thinks s/he gets paid by the post

No problem. The article may give you leads to google about. I also thought it may help those early retirees or those considering early retirement.

Oby, thanks for the link. As bUU pointed out, that news item is a proposal, and affects retired, not current, employees.

Last edited:

FIRE'd@51

Thinks s/he gets paid by the post

- Joined

- Aug 28, 2006

- Messages

- 2,433

Oby, thanks for the link. As bUU pointed out, that news item is a proposal, and affects retired, not current, employees.

bUU also acknowledged that there's nothing in ACA to prevent companies (or municipalities) from ending their coverage for current employees and dumping them on the exchanges, which was essentially the question OP asked.

I thought the OP was a general question on the PPACA, and some helpful links were provided in response. Still no luck finding a link on the Chicago health care report, though I've searched quite a bit this morning. Have you found one? With so much confusion, it helps to keep fact and speculation separate.bUU also acknowledged that there's nothing in ACA to prevent companies (or municipalities) from ending their coverage for current employees and dumping them on the exchanges, which was essentially the question OP asked.

ziggy29

Moderator Emeritus

Agreed, though it's probably retirees where it makes the most sense for employers (the few who still do provide this coverage), since they can foist off their highest costs on "the system" while continuing to insure the younger (and generally healthier) folks still of working age.bUU also acknowledged that there's nothing in ACA to prevent companies (or municipalities) from ending their coverage for current employees and dumping them on the exchanges, which was essentially the question OP asked.

I have my own personal opinion of the ACA but I've worked hard to set it aside for the comments I'm about to write, so nothing is written with the intent to start a political discussion - these are simply my observations.

As a freelance CPA, I work closely with a number of small businesses. I'll admit the sample size is too small to draw nationwide conclusions, but the observations are noteworthy (IMHO). These are the facts (for my clients at least): (1) the rates of increase in the premiums they are charged for health insurance for their employees has grown significantly in the years since ACA passed (versus the immediately preceding few years). (2) The carriers are saying that the increased mandates with the ACA are a driving force behind the increased rates of growth. They are also saying they expect that to continue as more mandates become effective. I can't prove these statements are true - but I can attest to the fact that this is what they are directly telling me. Even if this is untrue (and they're simply using the ACA as an excuse to charge more) it doesn't change the fact they my clients rates have significantly increased. (3) The penalties for not covering employees are small compared to even the most basic, "inexpensive" health plan (in fact the penalty is $0 if less than 50 employees). I've personally participated in planning meetings where it's being contemplated to cease offering coverage when the exchanges are set up. They plan to increase the pay to the employees (to help them pay the premiums for the policies they acquire on their own) as a part of the plan to drop coverage.

I believe (although I'm certainly biased) that my clients genuinely care for their employees and don't want to cancel coverage, but as the mandates of ACA continue to drive up the premiums (which is what the carriers are saying), they may be forced to drop coverage. It's not greed on their part (especially since they want to increase the pay rates to reallocate the "savings" from not paying health premiums) - it's economics.

Whether you like the ACA or disapprove of it, all must admit (IMO) that the market will respond to the changes in the health insurance environment. Perhaps the changes will be positive for the over-all health care/insurance market - I guess we'll all find out soon enough. But from what I've seen, it'd be folly to assume that since you get your health insurance coverage from a private employer that you're not subject to potentially significant changes due to the ACA mandates.

As a freelance CPA, I work closely with a number of small businesses. I'll admit the sample size is too small to draw nationwide conclusions, but the observations are noteworthy (IMHO). These are the facts (for my clients at least): (1) the rates of increase in the premiums they are charged for health insurance for their employees has grown significantly in the years since ACA passed (versus the immediately preceding few years). (2) The carriers are saying that the increased mandates with the ACA are a driving force behind the increased rates of growth. They are also saying they expect that to continue as more mandates become effective. I can't prove these statements are true - but I can attest to the fact that this is what they are directly telling me. Even if this is untrue (and they're simply using the ACA as an excuse to charge more) it doesn't change the fact they my clients rates have significantly increased. (3) The penalties for not covering employees are small compared to even the most basic, "inexpensive" health plan (in fact the penalty is $0 if less than 50 employees). I've personally participated in planning meetings where it's being contemplated to cease offering coverage when the exchanges are set up. They plan to increase the pay to the employees (to help them pay the premiums for the policies they acquire on their own) as a part of the plan to drop coverage.

I believe (although I'm certainly biased) that my clients genuinely care for their employees and don't want to cancel coverage, but as the mandates of ACA continue to drive up the premiums (which is what the carriers are saying), they may be forced to drop coverage. It's not greed on their part (especially since they want to increase the pay rates to reallocate the "savings" from not paying health premiums) - it's economics.

Whether you like the ACA or disapprove of it, all must admit (IMO) that the market will respond to the changes in the health insurance environment. Perhaps the changes will be positive for the over-all health care/insurance market - I guess we'll all find out soon enough. But from what I've seen, it'd be folly to assume that since you get your health insurance coverage from a private employer that you're not subject to potentially significant changes due to the ACA mandates.

I'm one whose health insurance is "going away" under ObamaCare. For 30 years I've purchased HI from the AVMA (American Veterinary Medical Association). Received notice that as of 12/31/13, AVMA will no longer be able to sell HI to veterinarians. Under the new law, they would be required to sell their HI to anyone who wanted to buy it, and they're not equipped to do that.

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,264

I have my own personal opinion of the ACA but I've worked hard to set it aside for the comments I'm about to write, so nothing is written with the intent to start a political discussion - these are simply my observations.

As a freelance CPA, I work closely with a number of small businesses. I'll admit the sample size is too small to draw nationwide conclusions, but the observations are noteworthy (IMHO). These are the facts (for my clients at least): (1) the rates of increase in the premiums they are charged for health insurance for their employees has grown significantly in the years since ACA passed (versus the immediately preceding few years). (2) The carriers are saying that the increased mandates with the ACA are a driving force behind the increased rates of growth. They are also saying they expect that to continue as more mandates become effective. I can't prove these statements are true - but I can attest to the fact that this is what they are directly telling me. Even if this is untrue (and they're simply using the ACA as an excuse to charge more) it doesn't change the fact they my clients rates have significantly increased. (3) The penalties for not covering employees are small compared to even the most basic, "inexpensive" health plan (in fact the penalty is $0 if less than 50 employees). I've personally participated in planning meetings where it's being contemplated to cease offering coverage when the exchanges are set up. They plan to increase the pay to the employees (to help them pay the premiums for the policies they acquire on their own) as a part of the plan to drop coverage.

I believe (although I'm certainly biased) that my clients genuinely care for their employees and don't want to cancel coverage, but as the mandates of ACA continue to drive up the premiums (which is what the carriers are saying), they may be forced to drop coverage. It's not greed on their part (especially since they want to increase the pay rates to reallocate the "savings" from not paying health premiums) - it's economics.

Whether you like the ACA or disapprove of it, all must admit (IMO) that the market will respond to the changes in the health insurance environment. Perhaps the changes will be positive for the over-all health care/insurance market - I guess we'll all find out soon enough. But from what I've seen, it'd be folly to assume that since you get your health insurance coverage from a private employer that you're not subject to potentially significant changes due to the ACA mandates.

One of the things that the law has in it is a cap on earnings... they have to spend a certain threshold of the premiums on actual health care... IIRC the basic one is 80% (but I could be wrong)... so, if the insurance companies are lying and do not spend the higher premiums on health care they will have to give a rebate... our company got a rebate last year...

Yes, but if it passes a lot of retired folks from Chicago will see their premiums more than double.Oby, thanks for the link. As bUU pointed out, that news item is a proposal, and affects retired, not current, employees.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

jarts98 said:You're right about the rebate, thus the reason I don't believe they're lying and, in fact, the mandates are behind the increase in the rate of premium growth.

Your previous observations would be reflected in my current situation. My individual plan has not been subjected to the new rules, being grandfathered and with lifetime limits in effect. The premium has only went up $3 in the almost 3 years that I have had it.

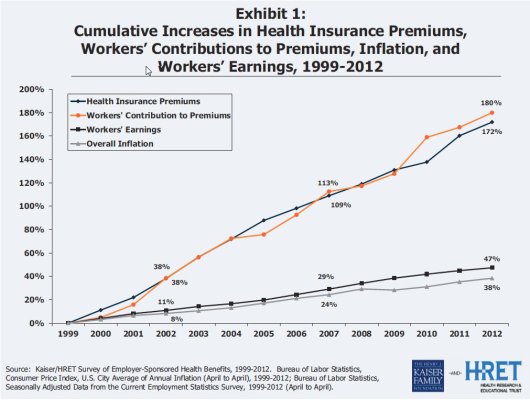

This chart from the Kaiser foundation shows an accelerated rate of growth for health care premiums dating back to 1999, around 5x the rate of inflation. The accompanying presentation can be found here http://ehbs.kff.org/pdf/2012/8345-Chartpack.pdfYou're right about the rebate, thus the reason I don't believe they're lying and, in fact, the mandates are behind the increase in the rate of premium growth.

Attachments

I'm one whose health insurance is "going away" under ObamaCare. For 30 years I've purchased HI from the AVMA (American Veterinary Medical Association). Received notice that as of 12/31/13, AVMA will no longer be able to sell HI to veterinarians. Under the new law, they would be required to sell their HI to anyone who wanted to buy it, and they're not equipped to do that.

So much for "If you like your health care plan, you can keep your health care plan."- Obama Aug 11, 2009 in New Hampshire

PolitiFact | Barack Obama promises you can keep your health insurance, but there's no guarantee

As I've said many times, only time will tell how the ACA will eventually play out.

Indeed and hopefully all companies that would otherwise pass-along more cost to employees than they'd have to pay for comparable insurance through ACA will end their own coverage. No one benefits from a situation where both employers and employees are paying more for health insurance.bUU also acknowledged that there's nothing in ACA to prevent companies (or municipalities) from ending their coverage for current employees and dumping them on the exchanges, which was essentially the question OP asked.

Presumably that would be something that the employer would have wanted to accomplish either way, either through direct premium pass-along increases, or short-changing the quality of the insurance.Yes, but if it passes a lot of retired folks from Chicago will see their premiums more than double.

In the end, employers will do what they will, sometimes in the best interest of their business, occasionally even privately-owned businesses will act out of spite. There's no accounting for that in the context of the ACA - it doesn't require spitefulness, nor effectively fosters it, nor would it either forestall or foster business decisions made in the business' best interests.

Last edited:

Well, it's certainly true for small employers: The law was written specifically to allow them to use the exchanges. There is also an official new program to offer these same small employers tax credits if they continue to provide coverage that meets the ACA guidelines (so, no traditional HDHPs, etc).I've seen this [that employers may dump employees into exchanges] written elsewhere on the forum but can't find a source. Do you have a link or info source to this?

Large employers (over 50 FTE): Employers just need to make an assessment as to whether it's better to pay the fine/tax or provide coverage. It's not simply a matter of which is cheaper for them, since keeping good employees is also important. In some cases (e.g. low wage employees) it may help attract employees if employers >don't< provide coverage, since the employee will do better by taking the taxpayer-offered subsidy and the employers can offer increased cash compensation (e.g. maybe matching their present health care contribution minus the fine/tax. If that was the level of compensation needed to keep quality employees before, maybe it would be tha same afterward). This may be viewed as an asset transfer from government to businesses (just as the subsidy for small employers is a "tax expenditure").

I'm not being a wiseacre-- would links about any of this be illuminating? You know the ACA, so I'm guessing this isn't news.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Replies

- 87

- Views

- 9K

- Replies

- 13

- Views

- 851

Latest posts

-

-

-

-

-

-

-

-

What new series are you watching? *No Spoilers, Please*

- Latest: sengsational

-