|

|

01-24-2015, 12:08 PM

01-24-2015, 12:08 PM

|

#41

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2007

Posts: 14,328

|

Quote: Quote:

Originally Posted by audreyh1

She would not have had her cancer treated until she eventually got on Medicaid. So, yes, I think she would likely die without timely intervention. Treating cancer is a race against the clock.

|

Thanks - I should have been more clear. What I was trying to tease out was whether hospitals' obligation to treat the uninsured had changed with the ACA and mandatory health care coverage.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

01-24-2015, 01:05 PM

01-24-2015, 01:05 PM

|

#42

|

|

Thinks s/he gets paid by the post

Join Date: Apr 2011

Location: Madison

Posts: 1,337

|

Obamacare shock. I'm "Shocked, I tell you, shocked"

Sent from my iPad using Early Retirement Forum

__________________

Wild Bill shoulda taken more out of his IRA when he could have. . . .

|

|

|

01-24-2015, 01:32 PM

01-24-2015, 01:32 PM

|

#43

|

|

Full time employment: Posting here.

Join Date: Dec 2006

Posts: 881

|

Quote: Quote:

Originally Posted by Accidental Retiree

I have a slightly different issue coming up and I have no idea how it's going to play out come tax time, but I think it's going to be ugly.

We moved from one California county to another in June 2014. Before the move, our premium was quite high, but our tax credit was high as well. After the move, our overall premium dropped about 25%, but our tax credit also dropped, making our share 6 times what we'd paid.

It took me over 2 months and many phone calls to get CoveredCA to process our new address. In the meantime, I kept throwing money at Anthem, per CoveredCA's direction, to make sure we didn't lose coverage. We kept the same plan and had the same income; we only changed address.

It took CoveredCA another few months to send our updated information to Anthem, so Anthem kept returning my now-increased premium checks. I knew Anthem didn't have our new address because I kept getting the forwarded premium invoices.

When I called Anthem to tell them we'd moved, they said they would not accept this from me. It could only come from Covered CA.

The upshot is that CoveredCA sent the wrong move date and we ended up getting billed in our new area for the whole year. We found this out in December. Any premiums we'd paid all through the year at the lower cost were piled together to pay those new, higher premiums.

As a result, a doctor's visit claim in December got denied; Anthem told our doctor that we had not paid any premiums since March of 2014! I talked to the doctor's office and told them what was going on. It's hard enough to find doctors who even take that insurance, so I wanted not to leave them hanging.

Once again I called Anthem, who explained how those premiums were applied--albeit wrongly--but they would not accept my word for it, so I've tried to call CoveredCA. No luck with that, during Open Enrollment. I could never even get to a real person to talk to.

Today I'll send a letter out to CoveredCA, asking them to give Anthem the correct information.

According to what I've seen from Anthem, we also lost the tax credit, which was substantial, for the first 5 months of the year. I am hoping that if CoveredCA changes the date with Anthem, they'll also wake up and fix the tax form that should be coming our way.

On a positive note, I sent Anthem some more money, and they kept it this time, which unlocked the benefits for the December doctor's visit. Since we're on a Bronze HSA plan, of course we're only benefiting from the negotiated rates, but still, we're glad to have insurance.

PS We left Anthem and moved to Kaiser for 2015. So far, we're really happy with Kaiser, but we still want to get Anthem sorted out for 2014. |

Agree. Had similar issues with Covered California "talking" to our Blue

Shield Carrier. Any changes, HAVE to go thru Covered CA. But it takes

Months, (not days as promised) for Covered CA to inform Blue Shield of

any changes. In the meantime, We, like you, were paying premiums to

the wrong plan, just to insure coverage. Also, like you, when Covered CA

did "talk" to Blue Shield, they gave the wrong dates, when coverage stopped and started.

I can only imagine what will happen when we have to fill out income tax

forms.....Expect another mess, HOPE the press does not do a coverup

|

|

|

01-25-2015, 07:36 AM

01-25-2015, 07:36 AM

|

#44

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2010

Posts: 2,301

|

Quote: Quote:

Originally Posted by NW-Bound

In late 2013 when ACA first came online and there was a lot of discussion at this forum and I was paying attention to learn about it from more informed posters, I remember that someone, MichaelB or perhaps Paquette, posted a link to the following Congressional Research Paper: http://www.healthreformgps.org/wp-co...redit-7-18.pdf. |

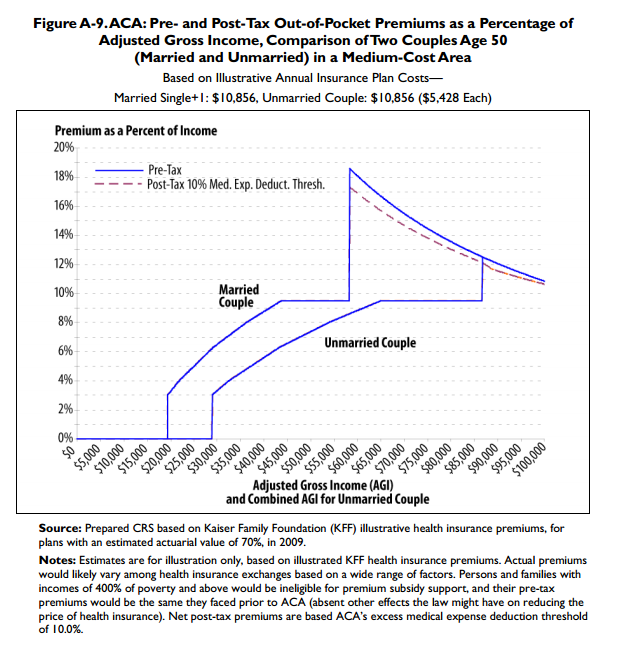

Thanks for posting the link to the paper and graph. I had not seen it before and skimming through it there's some interesting information in it.

The graph presents the premium as a percent of income (so different from absolute subsidy $) but to me seems also fairly well behaved (no discontinuities) until you get to the 400% cliff. In the back of my mind, I knew that there is a "marriage penalty" as the FPL for 2 people is not 2x the level of an individual -- it's actually only about 35% more. However the graph really hits home how large it can be (depends on age and is worse for older folks).

The article argues that two can live more cheaply than one, and I do believe this should be a factor in determining what the FPL for different family sizes. I'm not sure though that they put a lot of thought into the adjustment size. When I look at FPL tables it seems that for every person added to the family, the FPL goes up by a constant $4060. I'd expect some variation here. On the other hand, I know humans often expect to see complex models when sometimes a simple one will do fine by objective criteria.

Quote: Quote:

Originally Posted by wolf

Agree. Had similar issues with Covered California "talking" to our Blue

Shield Carrier. Any changes, HAVE to go thru Covered CA. But it takes

Months, (not days as promised) for Covered CA to inform Blue Shield of

any changes. In the meantime, We, like you, were paying premiums to

the wrong plan, just to insure coverage. Also, like you, when Covered CA

did "talk" to Blue Shield, they gave the wrong dates, when coverage stopped and started.  |

I've had similar problems with covered CA and blueshield as we switched accounts/plans from 2014 to 2015. I think someone on this board (maybe brewer12345?) has suggested shopping for a new plan every open enrollment but my experience this year has just been terrible. I won't want to touch it again once it's finally setup properly.

|

|

|

01-25-2015, 08:29 AM

01-25-2015, 08:29 AM

|

#45

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2014

Posts: 2,511

|

Quote: Quote:

Originally Posted by NW-Bound

In late 2013 when ACA first came online and there was a lot of discussion at this forum and I was paying attention to learn about it from more informed posters, I remember that someone, MichaelB or perhaps Paquette, posted a link to the following Congressional Research Paper: http://www.healthreformgps.org/wp-co...redit-7-18.pdf.

There's a lot of details in that paper, and I admit that I only glanced through it, but what caught my eyes was the following graph near the end. The plot shows the subsidy indirectly in the form of premium as a percentage of income, hence it takes some thinking to comprehend and to compare it with a graph that shows dollar amounts.

It is easy to see that the cliff is much more pronounced for a married couple; yet another marriage penalty in the US tax code.

|

This is really scary for me. I took my 2013 taxes... dropped the income to the 2.5 months I'll get paid for this year + the 6 weeks vacation buy out for my wife and ended up just under the cliff. But looking closer.. I don't think I'll stay under unless I sideline some investments.

|

|

|

01-26-2015, 11:02 AM

01-26-2015, 11:02 AM

|

#46

|

|

gone traveling

Join Date: Apr 2011

Posts: 3,375

|

Quote: Quote:

Originally Posted by marko

Always a good idea to leave some extra space in your income plan for unseen spikes. Best to adjust our MAGI to be about $10K short of the cliff and be able to pull it in after the numbers come in, than to be $1 over!

|

Yep. Got caught in that last year by about $1100.

|

|

|

01-27-2015, 06:48 PM

01-27-2015, 06:48 PM

|

#47

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,364

|

I agree the cliff is stupid but I suspect if the subsidies had been graded out more sensibly that the subsidies would have broken the budget more than it already did.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

01-27-2015, 07:16 PM

01-27-2015, 07:16 PM

|

#48

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Posts: 5,350

|

Quote: Quote:

Originally Posted by clifp

I definitely feel sorry for the self-employee contractor healthy folks in their late 20s who previously didn't have insurance, cause it was too expense. Imagine a 28 year old woman making $25K a year, she reluctantly signed up for $140/month silver plan, thanks in part for a $1100/year subsidy. At the end of the year she gets a $5,000 contract causing her to have to work through the holidays. As a reward she is hit with $750 in Federal tax $700 in FICA, say 5% $250 in state income tax,and whooping $800 in ACA subsidy reduction. Congrats she hit the 50% marginal tax bracket.

If she had been savvy she would have insisted they pay her next year, but she is too busy to hang around on forums like this..

|

This is very similar to my situation for 2014 except i'm a 35 year old male. I'm self employed doing contract work. I got a contract at the end of the year for $5250. I was able to get them to pay me $3000 in 2014 and $2250 in 2015 but it still had a very similar effect to what you described. Definitely a hard hit for someone who already is not making a lot of money.

|

|

|

01-27-2015, 07:29 PM

01-27-2015, 07:29 PM

|

#49

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Posts: 5,350

|

Quote: Quote:

Originally Posted by clifp

I am not saying that having insurance is a bad thing, just that the ACA create some perverse incentives because of the subsidies.

As a practical matter, the $1,700 medical insurance, plus the $6,600 deductible, plus the lost wage for being out of work for the cancer treatments, will more than likely push most self-employed 28 year olds making 25K into bankruptcy. It really doesn't matter if the cancer cost $50K or 200K almost nobody ends up paying that.

|

Another problem comes into play for the states that didn't expand medicaid(like mine). Lets say I had to have surgery that put me out of work for months since my job requires me to be healthy. I don't know the exact numbers but lets say $11,500 qualifies me for a great subsidy and cost sharing with $500 OOP max and $500 deducible. Lets also assume $11,499 or less means I get no subsidy or cost sharing and a deductible of $6000. The full premium is probably $3000 more without the subsidy. Add that to the $5500 extra deductible and I have to pay $8500 extra because I made too little money. How do I pay $9000 in medical bills if I made under $11,499 AGI.

I think the ACA is a big improvement over what we had before but it has a lot of flaws. Some are big. The one described above is huge. I think the solution is medicaid gets expanded at the federal level. I know many will not like that but it's necessary.

|

|

|

01-27-2015, 07:44 PM

01-27-2015, 07:44 PM

|

#50

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Posts: 3,083

|

Quote: Quote:

Originally Posted by aaronc879

I think the solution is medicaid gets expanded at the federal level. I know many will not like that but it's necessary.

|

The original law got Medicaid expanded at the federal level. The Supreme Court ruled that the ACA was coercive to the states due to the fact it threatened to take away all Medicaid funding if they did not comply with the expansion. So each state has the right to NOT expand without any loss of existing Medicaid funds.

Each state legislature must decide to expand, no other way it can be done.

|

|

|

01-27-2015, 07:57 PM

01-27-2015, 07:57 PM

|

#51

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Posts: 5,350

|

Quote: Quote:

Originally Posted by jim584672

The original law got Medicaid expanded at the federal level. The Supreme Court ruled that the ACA was coercive to the states due to the fact it threatened to take away all Medicaid funding if they did not comply with the expansion. So each state has the right to NOT expand without any loss of existing Medicaid funds.

Each state legislature must decide to expand, no other way it can be done.

|

Based on what you said, it's my opinion that the original law was good and the SC stepped in and made things much worse for no reason. I guess someone has to get the short straw.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|