|

|

10-24-2016, 02:13 PM

10-24-2016, 02:13 PM

|

#81

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,021

|

Quote: Quote:

Originally Posted by rayvt

Finances, period. stock market and mortgages are just different sub-sets.

"Over the full market cycle, investing to achieve short-term comfort costs a fortune." -- John Hussman

"Following the path of least emotional discomfort is a road to failure." -- Dorsey Wright

|

Quote Fight!!!

"What can be added to the happiness of a man who is in health, out of debt, and has a clear conscience?" -- Adam Smith

OK, so maybe I'll have to settle for two out of three.

__________________

Numbers is hard

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

10-24-2016, 02:23 PM

10-24-2016, 02:23 PM

|

#82

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2005

Location: DFW

Posts: 2,016

|

One of the smartest things I've done is pay off the mortgage. Now I get to use that mortgage money to fix things that need fixing.

We are out of debt, however. No mortgage, no car payments, no major bills of any kind. Life is good.

__________________

Resist much. Obey Little. . . . Ed Abbey

Disclaimer: My Posts are for my amusement only.

|

|

|

10-24-2016, 05:38 PM

10-24-2016, 05:38 PM

|

#83

|

|

Moderator Emeritus

Join Date: Feb 2005

Location: San Diego

Posts: 5,267

|

To those who chose to keep the mortgage, do you have zero bond holdings? I agree the math can work in the long run if you are 100% equities, I just wonder how many of you put that into practice.

|

|

|

10-24-2016, 05:58 PM

10-24-2016, 05:58 PM

|

#84

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2009

Location: Alberta/Ontario/ Arizona

Posts: 3,393

|

Quote: Quote:

Originally Posted by laurence

To those who chose to keep the mortgage, do you have zero bond holdings? I agree the math can work in the long run if you are 100% equities, I just wonder how many of you put that into practice.

|

If you had a mortgage and were 100% equities, your AA would be more than 100% equities given the fact the mortgage acts as a "negative bond". Perhaps OK when working but pretty aggressive if retired?

|

|

|

10-24-2016, 06:25 PM

10-24-2016, 06:25 PM

|

#85

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2006

Posts: 11,401

|

Quote: Quote:

Originally Posted by Danmar

If you had a mortgage and were 100% equities, your AA would be more than 100% equities given the fact the mortgage acts as a "negative bond". Perhaps OK when working but pretty aggressive if retired?

|

I'm unfamiliar with the term "negative bond". It's certainly different from "negative bond yield", which means paying someone to borrow your money. Is "negative bond" a term used in banking?

The way I see it is that my investment portfolio includes allocations to cash, equities, fixed income (bonds and preferreds) and investment real estate. The amount of real estate investment in my portfolio is the sum of the estimated market value of the properties, though in practice I use the purchase price unless I have had a recent appraisal. Of course, some (21%) of my portfolio is leveraged, but my current debt to total portfolio ratio is ~3% and falling.

When I calculate my net worth, I include all property assets, residential, rental and vacation, but I subtract the remaining mortgage liabilities, to get net worth.

|

|

|

10-24-2016, 06:47 PM

10-24-2016, 06:47 PM

|

#86

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2009

Location: Alberta/Ontario/ Arizona

Posts: 3,393

|

Quote: Quote:

Originally Posted by Meadbh

I'm unfamiliar with the term "negative bond". It's certainly different from "negative bond yield", which means paying someone to borrow your money. Is "negative bond" a term used in banking?

The way I see it is that my investment portfolio includes allocations to cash, equities, fixed income (bonds and preferreds) and investment real estate. The amount of real estate investment in my portfolio is the sum of the estimated market value of the properties, though in practice I use the purchase price unless I have had a recent appraisal. Of course, some (21%) of my portfolio is leveraged, but my current debt to total portfolio ratio is ~3% and falling.

When I calculate my net worth, I include all property assets, residential, rental and vacation, but I subtract the remaining mortgage liabilities, to get net worth.

|

I would say if your mortgages are on rental properties, you should ignore what I posted. My point is, as I tried (probably unsuccessfully in previous posts) to point out, paying a fixed amount is the opposite of receiving a fixed amount. If you had a bond you would be receiving a fixed payment with a mortgage you would be paying a fixed amount. For AA purposes you should treat the mortgage like a "negative bond". Hardly anyone does and it probably might only be an issue for retired people who aren't employed.

It's a bit like treating your pension as a proxy for FI in your AA only in the other direction. Probably a little too complicated and theoretical for most people.

|

|

|

10-24-2016, 07:53 PM

10-24-2016, 07:53 PM

|

#87

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2006

Posts: 11,401

|

Quote: Quote:

Originally Posted by Danmar

I would say if your mortgages are on rental properties, you should ignore what I posted. My point is, as I tried (probably unsuccessfully in previous posts) to point out, paying a fixed amount is the opposite of receiving a fixed amount. If you had a bond you would be receiving a fixed payment with a mortgage you would be paying a fixed amount. For AA purposes you should treat the mortgage like a "negative bond". Hardly anyone does and it probably might only be an issue for retired people who aren't employed.

It's a bit like treating your pension as a proxy for FI in your AA only in the other direction. Probably a little too complicated and theoretical for most people.

|

Thanks. I am retired, but I don't have a pension. That's why I have invested in real estate, to generate a noncorrelated, inflation linked income stream. As for treating a pension as proxy for FI in one's AA, I don't think that's too complicated for most people to understand. Moshe Milevsky explained it well in his book "Are you a Stock or a Bond?".

|

|

|

10-25-2016, 04:29 AM

10-25-2016, 04:29 AM

|

#88

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2009

Location: Alberta/Ontario/ Arizona

Posts: 3,393

|

Quote: Quote:

Originally Posted by Meadbh

Thanks. I am retired, but I don't have a pension. That's why I have invested in real estate, to generate a noncorrelated, inflation linked income stream. As for treating a pension as proxy for FI in one's AA, I don't think that's too complicated for most people to understand. Moshe Milevsky explained it well in his book "Are you a Stock or a Bond?".

|

Agree about pensions. People seem to have a bit of a problem going the other way with a mortgage. Did Milevsky mention them in his book? As you know mortgages in retirement are frowned on in Canada. Because of the structure of the US mortgage market and their tax code, mortgages in retirement are much more common in the US.

|

|

|

10-25-2016, 07:03 AM

10-25-2016, 07:03 AM

|

#89

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2007

Posts: 1,214

|

Quote: Quote:

Originally Posted by Danmar

If you had a mortgage and were 100% equities, your AA would be more than 100% equities given the fact the mortgage acts as a "negative bond". Perhaps OK when working but pretty aggressive if retired?

|

Seems to me that the phrase "negative bond" is an invented word, invented for the purpose of preemptively declaring one's side of the argument to be the winner.

As was said earlier, a mortgage is just an entry on the debit side of your net worth statement.

In the above discussions of the asset allocation aspect of paying off the mortgage, I didn't see any mention of the fact that paying off the mortgage puts a very large portion of your asset allocation into residential real-estate. A non-diversified, non-income-producing, illiquid asset.

I'd much rather have $1,300,000 in a 60/40 portfolio and a fully mortgaged $300,000 house than a $1,000,000 60/40 portfolio and a paid for house.

Because that last is not 60/40, it's really 46/31/23. 600K stocks, 400K bonds, 300K house.

The only risk with a mortgage is failure to service it -- failure to make the required monthly payments. And if your investment portfolio (a liquid, well-diversified portfolio if you please) is 3 or 4 or more times larger than the mortgage balance you don't really have any worries about that.

|

|

|

10-25-2016, 07:06 AM

10-25-2016, 07:06 AM

|

#90

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2006

Posts: 11,401

|

Quote: Quote:

Originally Posted by Danmar

Agree about pensions. People seem to have a bit of a problem going the other way with a mortgage. Did Milevsky mention them in his book? As you know mortgages in retirement are frowned on in Canada. Because of the structure of the US mortgage market and their tax code, mortgages in retirement are much more common in the US.

|

It's been years since I read this book, so I had to look it up on my Kindle. The second edition downloaded itself: nice! The search function turned up at least 20 instances of the word "mortgage". The discussion was substantive and consistent with how I have been framing it here. (I guess my thinking had been more influenced by Milevsky's writings than I realized, though I am not a fan of annuities). Nowhere does the concept of a mortgage as a negative bond come up. Milevsky, in this book, did not compare the mortgage markets in Canada and the US, and did not discuss taxation of mortgage interest. Most of his examples and references were US based. He pointed out the value of leverage as part of an overall asset allocation, but cautions that people working in jobs where income is closely tied to market performance (e.g. investment bankers) should eschew leverage, while those with steady "bond-like" income guarantees (e.g. tenured university professors, civil servants) are in a better position to leverage.

|

|

|

Mortage or not, it doesn't matter.

10-25-2016, 07:07 AM

10-25-2016, 07:07 AM

|

#91

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2007

Posts: 1,214

|

Mortage or not, it doesn't matter.

Firecalc shows that financially, a mortgage is slightly better than no mortgage.

Consider a $300K mortgage at 4%, P&I payment is $1432/mo or $17,184/yr. Assume an investment portfolio of $1.3M.

WITH MORTGAGE

$1.3M with $52K withdrawal (4%) has 95% success rate (30 years). Average final balance $2.4M. The withdrawal is increased by inflation. Mortgage payment comes out of the withdrawal, but that payment is fixed. The net spendable will go up over time, because the mortgage payment is fixed.

NO MORTGAGE

If you pay off the mortgage from the portfolio and keep the same net spendable withdrawal, the draw is $34,816 ($52k - $17,184).

When you plug $1M portfolio and $34,816 withdrawal, Firecalc reports 100% success rate. Average final balance $2.3M

SUMMARY

Financially, there is virtually no difference between keeping the mortgage or paying it off. Therefore, the decision to pay it off or not is a matter of personal preference.

|

|

|

10-25-2016, 07:13 AM

10-25-2016, 07:13 AM

|

#92

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2006

Posts: 11,401

|

Quote: Quote:

Originally Posted by rayvt

Firecalc shows that financially, a mortgage is slightly better than no mortgage.

Consider a $300K mortgage at 4%, P&I payment is $1432/mo or $17,184/yr. Assume an investment portfolio of $1.3M.

WITH MORTGAGE

$1.3M with $52K withdrawal (4%) has 95% success rate (30 years). Average final balance $2.4M. The withdrawal is increased by inflation. Mortgage payment comes out of the withdrawal, but that payment is fixed. The net spendable will go up over time, because the mortgage payment is fixed.

NO MORTGAGE

If you pay off the mortgage from the portfolio and keep the same net spendable withdrawal, the draw is $34,816 ($52k - $17,184).

When you plug $1M portfolio and $34,816 withdrawal, Firecalc reports 100% success rate. Average final balance $2.3M

SUMMARY

Financially, there is virtually no difference between keeping the mortgage or paying it off. Therefore, the decision to pay it off or not is a matter of personal preference.

|

I agree with your argument, provided that two assumptions are valid:

1. Portfolio gains exceed mortgage interest rate (which is likely at present rates, but what about the 1980s?)

2. Mortgage interest rate is constant throughout the amortization period.

Assumption 2 is valid in the US, but not in Canada. I'm not sure about other countries.

|

|

|

10-25-2016, 08:21 AM

10-25-2016, 08:21 AM

|

#93

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2009

Location: Alberta/Ontario/ Arizona

Posts: 3,393

|

Quote: Quote:

Originally Posted by rayvt

Firecalc shows that financially, a mortgage is slightly better than no mortgage.

Consider a $300K mortgage at 4%, P&I payment is $1432/mo or $17,184/yr. Assume an investment portfolio of $1.3M.

WITH MORTGAGE

$1.3M with $52K withdrawal (4%) has 95% success rate (30 years). Average final balance $2.4M. The withdrawal is increased by inflation. Mortgage payment comes out of the withdrawal, but that payment is fixed. The net spendable will go up over time, because the mortgage payment is fixed.

NO MORTGAGE

If you pay off the mortgage from the portfolio and keep the same net spendable withdrawal, the draw is $34,816 ($52k - $17,184).

When you plug $1M portfolio and $34,816 withdrawal, Firecalc reports 100% success rate. Average final balance $2.3M

SUMMARY

Financially, there is virtually no difference between keeping the mortgage or paying it off. Therefore, the decision to pay it off or not is a matter of personal preference.

|

Makes sense. Firecalc generally also gives very good (or at least as good) results for a portfolio very high (even 100%) in equities. But that doesnt mean that everyone should go 100% equity. And that is my only point, having a mortgage, at least in retirement effectively increases your equity allocation by decreasing your notional FI allocation. Yes, I coined the phrase "negative bond" in order to explain the effect it has on one's AA. I have no strong position on mortgages as long as you understand the effect it has on your AA.

|

|

|

10-25-2016, 09:24 AM

10-25-2016, 09:24 AM

|

#94

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,183

|

Quote: Quote:

Originally Posted by rayvt

SUMMARY

Financially, there is virtually no difference between keeping the mortgage or paying it off. Therefore, the decision to pay it off or not is a matter of personal preference.

|

+1

As mentioned earlier, I continue to be amazed at how much intense interest this subject draws since, for most folks, having a mortgage or paying it off means so little to their overall financial situation (assuming either scenario is dealt with prudently).

Perhaps it's the strong "anti-debt" feelings prevalent with some? Or the love of "leveraging" some others have? These extremes meet and form a storm of controversy where for most of us, paying off or not paying off the mortgage early means little to our overall financial situation.

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

10-25-2016, 10:02 AM

10-25-2016, 10:02 AM

|

#95

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2010

Location: Back woods of Fennario

Posts: 1,170

|

I paid off the mortgage on my vacation home-soon-to-be retirement home - it did feel good.

I have a mortgage on my current home at 2.625% and feel like I am using the leveraged capital to good use.

So I don't feel polarized. But it is a total myth that a paid off home is in any way free. You pay a hotel bill every night you lay your head on your pillow (taxes, insurance, current/future maintenance expenses) whether you like it or not.

__________________

"Time wounds all heels...." - Groucho Marx

|

|

|

10-25-2016, 10:22 AM

10-25-2016, 10:22 AM

|

#96

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2016

Location: Acworth

Posts: 1,214

|

Quote: Quote:

Originally Posted by youbet

+1

As mentioned earlier, I continue to be amazed at how much intense interest this subject draws since, for most folks, having a mortgage or paying it off means so little to their overall financial situation (assuming either scenario is dealt with prudently).

Perhaps it's the strong "anti-debt" feelings prevalent with some? Or the love of "leveraging" some others have? These extremes meet and form a storm of controversy where for most of us, paying off or not paying off the mortgage early means little to our overall financial situation.

|

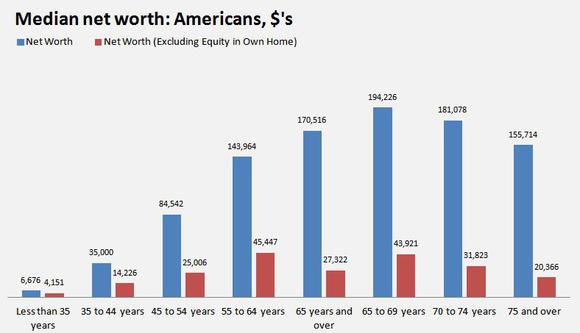

I think the following chart illustrates a large reason why paying off a mortgage is ingrained into society as a great accomplishment:

Most people's net worth is, by and large, their home and little else. That's not the case for many on this site and similar places, but that doesn't mean people haven't been influenced by the amount of financial freedom "most" people feel when they get out from under a mortgage payment that likely accounted for 20-40% of their monthly spending for most of their lives.

|

|

|

10-25-2016, 10:23 AM

10-25-2016, 10:23 AM

|

#97

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,183

|

Quote: Quote:

Originally Posted by LRDave

I paid off the mortgage on my vacation home-soon-to-be retirement home - it did feel good.

|

It's good that it felt good.

But, did paying off the mortgage on your vacation home make any material difference in your overall FIRE status? That is, were you in some sort of awkward situation with the mortgage because it had high rates or represented a large portion of your total worth? Or, like most of us when we pay off a mortgage, was it simply a minor balance sheet adjustment of insignificant consequence?

If it wasn't a big financial deal for ya, why did it feel so good? Just trying to understand this....... I guess I'm feeling left out since when we paid off the small balance on our mortgage years ago, it was a yawner. Maybe I just need to learn to bring a bit more emotion into my financial life?

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

10-25-2016, 10:29 AM

10-25-2016, 10:29 AM

|

#98

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2016

Location: Acworth

Posts: 1,214

|

Quote: Quote:

Originally Posted by youbet

It's good that it felt good.

But, did paying off the mortgage on your vacation home make any material difference in your overall FIRE status? That is, were you in some sort of awkward situation with the mortgage because it had high rates or represented a large portion of your total worth? Or, like most of us when we pay off a mortgage, was it simply a minor balance sheet adjustment of insignificant consequence?

If it wasn't a big financial deal for ya, why did it feel so good? Just trying to understand this....... I guess I'm feeling left out since when we paid off the small balance on our mortgage years ago, it was a yawner. Maybe I just need to learn to bring a bit more emotion into my financial life?

|

I know that my balance sheet won't change much by paying off my mortgage (which I plan to do in ~8 years currently). However, I know it will feel better emotionally when my "bills" drop by 30%+ as a result, regardless of the relative steadiness of my ability to pay for my lifestyle.

In my experience talking with people, debt is rarely a purely financial concern, there is often an emotional cost to owing money (heck, money problems are one of the leading reasons for divorce as well as some mental health issues including anxiety etc). For some, the emotional cost is small and they may just smile momentarily when they finally mark off a 6-7 figure debt from the balance sheet. For others, the worry of being able to pay that debt may have stolen years from their life being concerned about it and finally getting rid of it will feel like they just got the weight of the world off their shoulders. What's the price for peace of mind? How do you put that on a balance sheet?

|

|

|

10-25-2016, 10:51 AM

10-25-2016, 10:51 AM

|

#99

|

|

Full time employment: Posting here.

Join Date: Mar 2012

Location: seattle

Posts: 646

|

Quote: Quote:

Originally Posted by exnavynuke

What's the price for peace of mind? How do you put that on a balance sheet?

|

Here, Hear! [I spelled it both ways because I forgot how to spell it]

Those feelings that won't submit to being line entries are what make us human, and are critical in the end, [jmo]

|

|

|

10-25-2016, 11:01 AM

10-25-2016, 11:01 AM

|

#100

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2015

Location: the prairies

Posts: 5,046

|

It's different for everyone, but for people like me who want to own a home for the lifestyle it offers and only managed to earn a modest income, paying off a mortgage allows you to double or triple your monthly disposable income. So, yes, it may be reason to celebrate.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|