BrianB

Recycles dryer sheets

We are giving our daughter our 7 year old hatchback, so we will be in the market for a replacement. Looking at 2017 (used) or 2018 (new) vehicles and will probably spend near $20k.

My question is where to get the money, so that it won't add to our taxable income. I am over 59.5 years old and we've been retired for 3 years now.

1. Distribution from a contributory Roth IRA where we have cash from a previous sale that hasn't been reinvested yet. We have been doing small Roth conversions (into separate accounts) over the past 5 years, so this seems like a step backwards.

2. Sell something from our after tax account, mostly dividend stocks, preferreds, and REITS. Some appreciation would be income but 70-90% would be cost basis. This would reduce our annual dividend income that we currently spend.

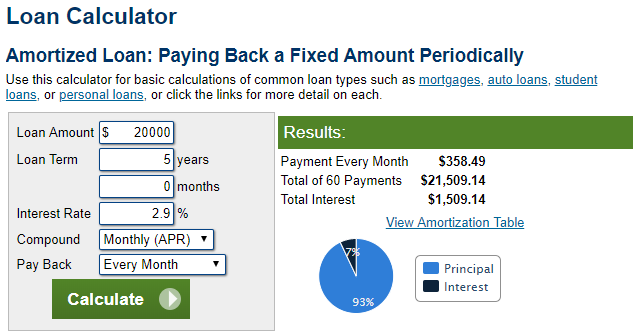

3. Use dealer financing at 2.9% / 5 years (or forego a $1500 rebate to get 0% on the new car option). Pay larger monthly payments as budget allows while hoping for no other major expenses to avoid doing 1. or 2. above and have the car paid in 2-3 years. This would crimp our budget a bit, and I hate debt.

All these options have pluses and minuses. I seem to go back and forth on which is better. Any suggestions or better ideas?

My question is where to get the money, so that it won't add to our taxable income. I am over 59.5 years old and we've been retired for 3 years now.

1. Distribution from a contributory Roth IRA where we have cash from a previous sale that hasn't been reinvested yet. We have been doing small Roth conversions (into separate accounts) over the past 5 years, so this seems like a step backwards.

2. Sell something from our after tax account, mostly dividend stocks, preferreds, and REITS. Some appreciation would be income but 70-90% would be cost basis. This would reduce our annual dividend income that we currently spend.

3. Use dealer financing at 2.9% / 5 years (or forego a $1500 rebate to get 0% on the new car option). Pay larger monthly payments as budget allows while hoping for no other major expenses to avoid doing 1. or 2. above and have the car paid in 2-3 years. This would crimp our budget a bit, and I hate debt.

All these options have pluses and minuses. I seem to go back and forth on which is better. Any suggestions or better ideas?

Last edited: