Delawaredave5

Full time employment: Posting here.

- Joined

- Dec 22, 2004

- Messages

- 699

So when you do tIRA to Roth conversions, the converted amount is treated as income on your tax return, correct ?

Friend of mine is retired, gets about $10,000 in SS payments, and draws RMD of about $5,000 from tIRA.

So the RMD and SS go into AGI - so the person has $15,000 in income. Any Roth conversions are "extra income".

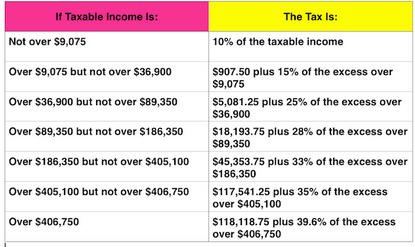

2014 tax tables show 15% tax on additional income up to $36,900.

So this person surely wants to Roth convert $21,900 to get to $36,900, right ?

Thanks !!!

Friend of mine is retired, gets about $10,000 in SS payments, and draws RMD of about $5,000 from tIRA.

So the RMD and SS go into AGI - so the person has $15,000 in income. Any Roth conversions are "extra income".

2014 tax tables show 15% tax on additional income up to $36,900.

So this person surely wants to Roth convert $21,900 to get to $36,900, right ?

Thanks !!!