Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

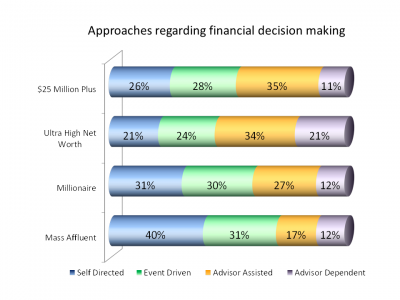

This comes up here often, but when I did a search I couldn't find anything newer than 2008. Though many of us may have used paid advisors years ago, I expect the % of DIY investors here is higher than the general population. I've attached a breakdown that I found online and here are the definitions they used (better than I could do on my own). There is nothing wrong with being in any category. I read another article that suggested that 73% of those who used an advisor, felt the advisor was value-added (some pride bias of course).

Just out of curiousity to see where this group falls. Definitions, specifically paid advisors, not free advice like here for example:

Just out of curiousity to see where this group falls. Definitions, specifically paid advisors, not free advice like here for example:

- An Advisor Dependent person relies on a Financial Advisor to make most of his or her investment decisions.

- An Advisor Assisted person relies upon the Financial Advisor for advice but feels that he or she ultimately makes the investment decision.

- A Life Event Driven assisted investor will reach out to use a Financial Advisor when he or she is making investments about significant life decisions (i.e. Retirement, divorce, etc.).

- Clearly a Self-Directed investor is someone who, for the most part, makes his or her own investment decisions without the help of a Financial Advisor.

Attachments

Last edited: