This

dynamic asset allocation video is from 2012. It's by a "professorial" kind of guy who explains how a static asset allocation can be improved upon by using the ratio between the PE's of two asset classes.

So this would fall under the "non constant mix" in the poll, but since the mix is not very dynamic, one might call it "corridor".

The beginning of the video is about a static asset allocation, but the link I posted starts at the point where he starts talking about dynamic asset allocation. The whole thing is worth watching, I think. It's 45 minutes or so, total, split about half on the topic of static and half on dynamic. There are

a lot of numbers, so if you're not into that kind of thing, skip the video. But if you want to get an idea of how some of these asset allocations along the

efficient frontier are arrived at, it's pretty enlightening.

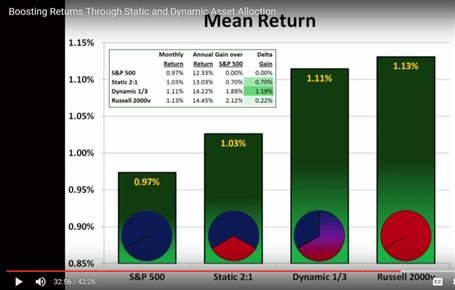

Basically what you have for the static allocation is historical returns split into a Morningstar style box (growth/value on one axis and large/small cap on the other). Based on that, an allocation of ETF's is selected that optimize using the efficient frontier and Sharpe ratio (balancing risk (volatility) with reward (return)). In the dynamic allocation, the ratio between the 10 year PE of the Russel 1000 (large) and Russel 2000 (small) is used to flip/flop 1/3 of the portfolio to either large or small. Doing that improves expected return significantly over the static allocation model.