pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

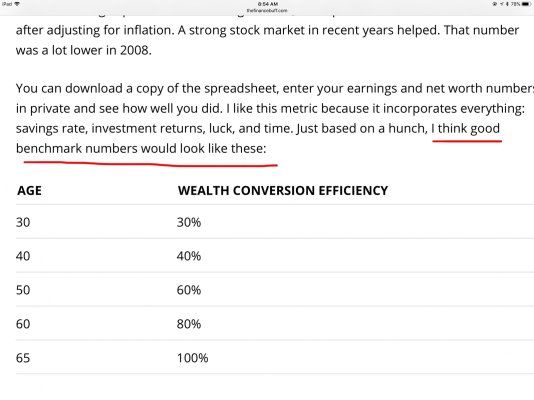

Interesting exercise. My WCE is based on networth/total income. I feel very fortunate at just over 100%, however I was lazy and did not include NPV of SS and future small pension of $13k, also too lazy to figure out inflation.

Inflation makes a huge difference... I'm well over 100% without inflation and my inflation adjusted WCE is about 2/3 my WCE without inflation.