I wonder what others think about the following as a way to FIRE with a fairly high withdrawal rate while attempting to manage Sequence of Returns risk, and Inflation risk. Full credit to Michael Kitches’ “increasing equities glide path” concept to get me thinking about adjusting it to my own situation.

Assumptions:

- FIRE at 58 with 12 years to go before maximum SS;

- Max SS projections at 70 currently show $70K/year combined for DW and me;

- $2M portfolio or > at FIRE with a 60/40 AA.

- No kids and no interest in dying with a lot of $ left.

Proposed Spend Strategy: Fixed Income allocation is $800,000 and 100% in TIPS.

1). Spend 1/12th of fixed income assets per year ($67,000) as a bridge to maximum SS.

2) Basically, at 70 we trade the dependability of bonds, which are mostly depleted, for the dependability of SS.

3). Biggest risk is probably that current SS projections won’t be messed with by Congress just as we start it, though it’s a risk that is a matter of opinion and I can’t calculate whether AARP will have a stronger lobby than the Military contractors when SS finally goes wobbly in about 2030. If it all goes to heck, Hello Central America?

4). Sequence of Returns Risk management: Safely spending down a fixed % of bonds to get to a safe maximum SS check.

5). Inflation Risk management: 100% TIPS, although Total Bond Market seems a good choice, too. I could see allocating 50% to each.

Proposed Spend Strategy: Equities = $1.2M in 100% Total Stock Market Index:

1). Spend a FIXED 4%/year with no inflation adjustment. Year One spend is $48,000.

2). Assuming 8% growth in equities over those 12 years and a 4% spend rate, the stock index would compound at 4%/year (right?) to become $1.9M in 12 years at age 70.

3). During years with a >$48,000 spend possible: Park the excess cash in treasuries

4). Years with < $48,000 spend possible: make up the loss from the parked cash.

5). Sequence Risk management: The risk is still there but hopefully not catastrophic because, theoretically, one could not deplete a stock portfolio with a fixed 4% spend rate. I checked this on FIREcalc, which showed 100% success.

6). Inflation Risk management: Growth in stock valuations over time. Year One spend @ 4% is $48,000 but Year 12 spend is $76,000.

I Realize:

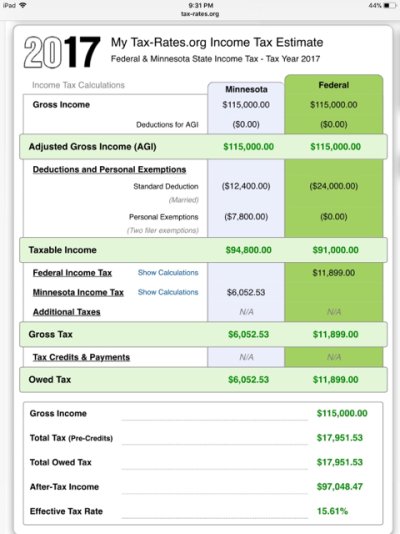

1). $115,000 year spending off a $2M portfolio in Year One is a high 5.75% withdrawal rate and not considered a “safe withdrawal rate.” But aren’t the usual risks managed pretty well above?

2). I’ve proposed a 12 year portfolio survival vs. the usual 30 year. But isn’t reaching SS securely with a dependable $70K/year for life that is inflation indexed, plus $1.9M in stocks “pretty good”? At that point, I could put the $1.9M in TIPS and spend 1/17th per year going forward ($111,764/year) plus max SS of $70K to get to a 30 year portfolio.

This is not traditional thinking, so tell me why it is whacked. Go on, I assume it has flaws I can’t see yet and I know you won’t be shy pointing them out, so please do