Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

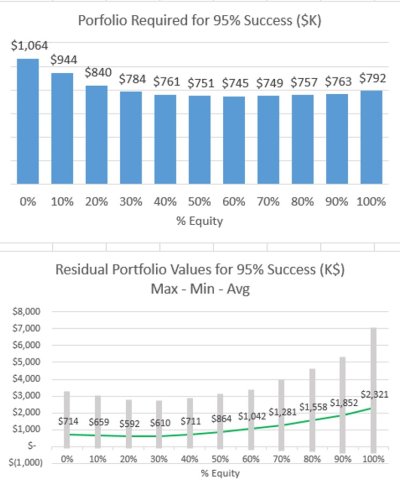

This has been done a few times, but it's been a while? Occasionally there are posts here about changing allocation slightly and usually the replies say it doesn't make much difference +/- 10% equity or even more. So here's what the FIRECALC database returns for spending $30K/yr inflation adjusted over a 30 year retirement at a 95% success rate. The point is not the $ amounts (e.g. we all know the outlook for fixed income/interest is less optimistic) - the point is what's required in relative terms at each AA. I hope we can leave the future returns prediction debates out of this.

There's not much difference between 30:80 and 80:20 in terms of success rate or portfolio required - that's all this exercise was meant to illustrate. One could argue the AA decision hinges largely on residual values.

And staying out of equities altogether (0% on chart) requires a portfolio 43% larger than being 60% in equities - that's a lot of extra years working, or considerably less spending. And with the current outlook for fixed income, the premium to exclude equities is even greater. I remember one very persistent zero equity member, but I don't know if we have any zero equity allocation investors left here?

I'm tempted to summarize other conclusions, but I'll let the audience draw their own, and there are others more qualified here anyway.

It may also help illustrate the risks of trying to time out and back into equities.

There's not much difference between 30:80 and 80:20 in terms of success rate or portfolio required - that's all this exercise was meant to illustrate. One could argue the AA decision hinges largely on residual values.

And staying out of equities altogether (0% on chart) requires a portfolio 43% larger than being 60% in equities - that's a lot of extra years working, or considerably less spending. And with the current outlook for fixed income, the premium to exclude equities is even greater. I remember one very persistent zero equity member, but I don't know if we have any zero equity allocation investors left here?

I'm tempted to summarize other conclusions, but I'll let the audience draw their own, and there are others more qualified here anyway.

It may also help illustrate the risks of trying to time out and back into equities.

Attachments

Last edited: