I don't understand why the USD has not devalued compared to the Euro after all the money printing here. Granted, Greece is an issue but nothing compared to California for example. I don't get it.

You're working on a simple model that increasing the Fed's balance sheet leads to an increase in money supply which therefore must cause inflation. That's not the way it actually works neither in the US in the current period nor in Japan in the period of 2001/2002 when the Bank of Japan increased the money supply by one third. Despite the increase in the money supply Japan subsequently, and currently, has experienced deflation. The US hasn't had deflation, but inflation has been very modest. In the case of the US the money that the Fed lent to banks did not become part of M1 money supply since the banks lent it back to the Fed for 0.25% interest. Here's the St. Louis Fed's graph of M1 money supply:

That's not much of a spike. The Fed balance sheet exploded by more than $2 trillion dollars, but there is no comparable increase in the money supply.

So that's the money supply argument for inflation. There are other matters to consider: the US, like Japan in the 90's, is in a balance-sheet recession. Households in the US are over-indebted and are payin debts, increasing savings and in some cases defaulting to reduce the over-indebtedness. This is a process that takes years. In Japan it was corporations rather than households and the balance sheet recovery took 15 years in many cases. If you really want to understand this read John C. Koo's "The Holy Grail of Macroeconomics" or find one of his videos on the internet.

So, consumer spending, the principal driver of the US economy, is restrained by indebtedness and further restrained by the continuing jobs depression that is a result of the burtsting of the housing bubble, the losses from derivatives, etc. I think the losses to housing are in the $8 trillion range at this point after 8 million foreclosures or so with another 3 or 4 million to go. That wealth never showed up in the money supply, but it drove the increase in consumer spending and now it's gone, perhaps never to return.

As for the value of the dollar, it is certainly looking good against its competitors, which is to say, the euro. With capital flight from the euro in Greece, Spain, and soon perhaps, Italy, which would you rather have? Although the right wing has been claiming for the past few years that the dollar will collapse because of the debt burden, just the opposite has happened: the dollar is up and the rates on the 10 year Treasury have dropped from 4.5% in 2007 to 1.59% today, close to historic lows. People are eager to lend to the US Treasury.

The yuan will not become a reserve currency for decades, if then, because the Chinese are not willing to run trade deficits and don't have well-developed capital markets, which are necessary for the reserve currency function. Other trading nations, like Japan, have similar reasons to avoid reserve currency status. Eventually, the dollar will share reserve currency status with several others. The go-to economist for the dollar is Barry Eichengreen.

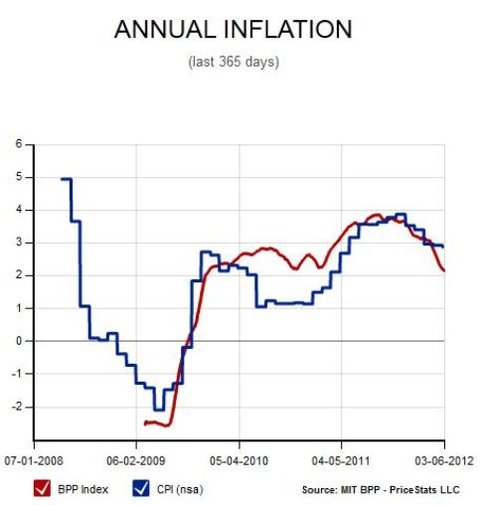

So, the dollar has gone up since the start of the Great Recession, not down. Inflation has remained low and will do so for some time to come. My guess is that will be longer than many people suppose. Japan is the model here: credit bubble, asset bubbles, bubbles burst, long, long recovery time.