|

|

10-26-2010, 10:51 AM

10-26-2010, 10:51 AM

|

#141

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2005

Posts: 4,391

|

Quote: Quote:

Originally Posted by keegs

Ron,

What I meant is that in our free market system, where many alternatives are available, voters have declined the privatization option.

SS is just like any other fixed annuity, you don't get to pick how the issuer invests the funds. My understanding is that SS funds are invested in treasuries backed by the full faith and credit of the US government. It's a credit worthiness that investors continue to flock to.

The only threat to your investment in social security is the voter. Which leads me to assume that these arguments about SS serve an ideological agenda.

|

So what do you do when the trust fund isn't available and the SS taxes coming in don't pay for what is promised ?

What's your plan then ?

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

10-26-2010, 10:56 AM

10-26-2010, 10:56 AM

|

#142

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Quote: Quote:

Originally Posted by keegs

What I meant is that in our free market system, where many alternatives are available, voters have declined the privatization option.

|

Actually, "voters" haven't declined anything other than that they didn't vote for enough supporters of "privatization" to get it passed. It's not like they were given a direct referendum on a single issue.

Plus, as much as voters tend to support the generic idea that "we need change," they tend to oppose significant change when they hear the details of the proposal -- regardless of the issue involved.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

10-26-2010, 11:45 AM

10-26-2010, 11:45 AM

|

#143

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2005

Location: Lake Livingston, Tx

Posts: 4,204

|

Keegs,

I am in the camp that voters did not vote. Lots of spin in the news, but I don't remember either party bringing this to a vote.

I also have a problem with the government investing in their own government bonds, and saying this is the safest. I bought some bonds from myself, they pay 50% interest, and I can't think of anyone I trust more than me. I am now worth over a billion dollars, however, I am going to have to borrow a ton of money to pay myself.

The government took in SS tax, turned it into general fund revenue via bond sales, and spent the revenue. Just where do you propose they are going to get the money to pay back those bonds? With a trillion dollar annual deficit, it sure looks like it is going to be borrowed.

__________________

If it is after 5:00 when I post I reserve the right to disavow anything I posted.

|

|

|

10-26-2010, 11:47 AM

10-26-2010, 11:47 AM

|

#144

|

|

Full time employment: Posting here.

Join Date: Apr 2010

Posts: 853

|

Quote: Quote:

Originally Posted by keegs

SS is just like any other fixed annuity, you don't get to pick how the issuer invests the funds. My understanding is that SS funds are invested in treasuries backed by the full faith and credit of the US government. It's a credit worthiness that investors continue to flock to.

|

Do tell how I could invest more than the mandated $6620/yr. I never thought about it this way and it seems like such a great deal! Anyone else want a piece of this action?

|

|

|

10-26-2010, 11:51 AM

10-26-2010, 11:51 AM

|

#145

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Quote: Quote:

Originally Posted by ronocnikral

Do tell how I could invest more than the mandated $6620/yr.

|

Become self-employed. Then you could invest twice as much.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

10-26-2010, 11:59 AM

10-26-2010, 11:59 AM

|

#146

|

|

Full time employment: Posting here.

Join Date: Apr 2010

Posts: 853

|

touche. i often forget DW has to do this, as my wages from the business have no SS. i'm fortunate to have such a kind employer to pickup the other half for me.

|

|

|

10-26-2010, 12:11 PM

10-26-2010, 12:11 PM

|

#147

|

|

Recycles dryer sheets

Join Date: Oct 2010

Location: In a van down by the river

Posts: 407

|

Quote: Quote:

Originally Posted by MasterBlaster

So what do you do when the trust fund isn't available and the SS taxes coming in don't pay for what is promised ?

What's your plan then ?

|

Tax cuts don't pay for themselves and neither will SS.

|

|

|

10-26-2010, 12:12 PM

10-26-2010, 12:12 PM

|

#148

|

|

Recycles dryer sheets

Join Date: Oct 2010

Location: In a van down by the river

Posts: 407

|

Quote: Quote:

Originally Posted by ziggy29

Actually, "voters" haven't declined anything other than that they didn't vote for enough supporters of "privatization" to get it passed. It's not like they were given a direct referendum on a single issue.

Plus, as much as voters tend to support the generic idea that "we need change," they tend to oppose significant change when they hear the details of the proposal -- regardless of the issue involved.

|

You're right Ziggy...there wasn't a referendum.

|

|

|

10-26-2010, 12:28 PM

10-26-2010, 12:28 PM

|

#149

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2004

Location: SW Ohio

Posts: 14,404

|

Quote: Quote:

Originally Posted by keegs

Tax cuts don't pay for themselves

|

Sometimes they do, sometimes they don't.

Quote: Quote:

Originally Posted by keegs

and neither will SS.

|

Makes no sense.

|

|

|

10-26-2010, 12:38 PM

10-26-2010, 12:38 PM

|

#150

|

|

Full time employment: Posting here.

Join Date: Feb 2009

Posts: 886

|

Quote: Quote:

Originally Posted by samclem

Sometimes they do, sometimes they don't.

.

|

Andrew Samwick, a Dartmouth economist who was chief economist at the Council of Economic Advisers early in the George W. Bush administration, expressed a view most economists endorse: "You know that the tax cuts have not fueled record revenues. You know that the first effect of cutting taxes is to lower tax revenues. The ultimate reduction in tax revenues can be less than this first effect, because lower tax rates encourage greater economic activity. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one."

As noted at the top of this column, Joel Slemrod, who served as a tax specialist on the staff of Ronald Reagan's Council of Economic Advisers in the 1980s, strongly agrees.

So does Martin Feldstein, a Harvard economist who headed the CEA in Reagan's first administration. Feldstein led the respected National Bureau of Economic Research for 30 years.

And there's Greg Mankiw, who headed the CEA for George W. Bush and made the "cranks and charlatans" remark about advocates of self-paying tax cuts.

These are just four highly respected economists who served in Republican administrations. One could go on and on listing others. And it is exceedingly difficult to find any prominent ones who disagree with them.

Read more: Lotterman: The myth of tax cuts that pay for themselves poses a threat | Edward Lotterman's columns | Idaho Statesman

|

|

|

10-26-2010, 01:06 PM

10-26-2010, 01:06 PM

|

#151

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2004

Location: SW Ohio

Posts: 14,404

|

Quote: Quote:

Originally Posted by samclem

Sometimes they do, sometimes they don't.

|

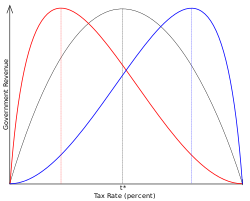

Some reading for those who haven't yet made up their mind.

Supply-Side Economics: The Concise Encyclopedia of Economics | Library of Economics and Liberty

Bottom line--the effects of tax cuts in enhancing government revenues are long-term rather than short-term, and more pronounced if marginal rates are higher.

Laffer and others note that government revenues increase with tax rate decreases only when the existing tax rates are in the right portion of the curve.

(Figure from Wikipedia)

Laffer curve: t** represents the rate of taxation at which maximal revenue is generated. Here the curve is symmetric for simplicity, which is not realistic.

|

|

|

10-26-2010, 01:31 PM

10-26-2010, 01:31 PM

|

#152

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2006

Posts: 4,872

|

Quote: Quote:

Originally Posted by samclem

Some reading for those who haven't yet made up their mind.

Supply-Side Economics: The Concise Encyclopedia of Economics | Library of Economics and Liberty

Bottom line--the effects of tax cuts in enhancing government revenues are long-term rather than short-term, and more pronounced if marginal rates are higher.

Laffer and others note that government revenues increase with tax rate decreases only when the existing tax rates are in the right portion of the curve.

(Figure from Wikipedia)

Laffer curve: t** represents the rate of taxation at which maximal revenue is generated. Here the curve is symmetric for simplicity, which is not realistic. |

I expect everyone accepts that some level of taxation is necessary, although I bet there are some that would even argue that point. The problem then becomes to decide what it should pay for and how it should be levied. The difficulty with this is that it's an almost infinitely complex series of differential equations with dependent variables. Napkin curves like Laffer's offer only the most simplistic insight into the problem.

|

|

|

10-26-2010, 01:46 PM

10-26-2010, 01:46 PM

|

#153

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2004

Location: SW Ohio

Posts: 14,404

|

Quote: Quote:

Originally Posted by nun

Napkin curves like Laffer's offer only the most simplistic insight into the problem.

|

True, just as Laffer himself said. The Laffer Curve is much more a rhetorical/explanatory tool than a precise econometric model. But, there's some tax rate above which government revenues will decrease, not increase. And, there's no doubt that US government revenues have sometimes increased after decreases in tax rates, but that's no firm proof of causality.

And, just to be clear, I resist the notion that our goal should be to find that optimum tax rate that produces the highest government revenue (i.e. just as a physician shouldn't ask "How much can we bleed the patient each day to gain the greatest amount of blood over time--if we take too much he gets so sickly that output decreases." Our goal should be on the health of the patient--our people, and the private economy that sustains us).

|

|

|

10-26-2010, 01:55 PM

10-26-2010, 01:55 PM

|

#154

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,889

|

Quote: Quote:

Originally Posted by kyounge1956

I chose age 5 because the original suggestion was to increase retirement age for everyone born after 2000, and the age 5's were the first age group in the statistics who would fit that description.

|

Ok, gotcha. But that leads to other complexities - we don't know what their LEs will be at retirement or after they've paid into the system for a while. The data you presented shows how tricky it gets, with the LE going back-and-forth between the groups at different times. That's why I'm saying ' forget about it' (as far as SS goes), and treat SS as it was intended, an annuity for life. So that does not come across as cold, let me add that it would be good for this country to understand the underlying issues of why the poor have lower LE, and to try to improve that (the obvious answer is fewer poor people, but at least address specific issues of the poor). If some of it is unique to gender or race, that would come out as part of the research.

Quote: Quote:

Neither Emeritus nor I suggested that policy should be based on this. You "called him out" for something he didn't say. ... Maybe this discrepancy is, as suggested elsewhere in the thread, more of a high income/low income effect, and partly or fully canceled out by the progressive nature of SS benefits.

|

True, I wasn't clear - let me expand a bit.

I didn't mean to imply that either of you said that policy should be based on this (neither did). I was asking if you think we should base policy on this, otherwise - why bring it up? And why define it in terms of race, when (as samclem reminded us) it is probably more appropriate to say that people with low LE would be disproportionately affected - generally the poor, people with medical conditions, poor genes, addiction or other risky behaviors, or bad lifestyle choices (addiction may not be a "choice").

Quote: Quote:

Originally Posted by Emeritus

Securing the general Welfare is one of the reasons people founded this country.

|

OK. But raising the retirement age for SS (if that is what you are referring to) in the future is an awfully l-o-o-o-o-o-o-n-g stretch from our Founding Fathers. Outside of the military, this sort of "general welfare" did not seem to be legislated much.

An aside: The stuff I learn reading/researching on this forum! I googled US military pension history - if internet forums existed in the late 1700's I think we'd be surprised how little has changed:

Public Sector Pensions in the United States | Economic History Services

Quote: Quote:

|

Congress authorized the payment of a life annuity, equal to one-half base pay, to all officers remaining in the service for the duration of the Revolution. It was not long before Congress and the officers in question realized that the national governments' cash-flow situation and the present value of its future revenues were insufficient to meet this promise. Ultimately, the leaders of the disgruntled officers met at Newburgh, New York and pressed their demands on Congress, and in the spring of 1783, Congress converted the life annuities to a fixed-term payment equal to full pay for five years. Even these more limited obligations were not fully paid to qualifying veterans, and only the direct intervention of George Washington defused a potential coup (Ferguson 1961; Middlekauff 1982).

|

-ERD50

|

|

|

10-26-2010, 02:38 PM

10-26-2010, 02:38 PM

|

#155

|

|

Recycles dryer sheets

Join Date: Oct 2010

Location: In a van down by the river

Posts: 407

|

Quote: Quote:

Originally Posted by samclem

True, just as Laffer himself said. The Laffer Curve is much more a rhetorical/explanatory tool than a precise econometric model. But, there's some tax rate above which government revenues will decrease, not increase. And, there's no doubt that US government revenues have sometimes increased after decreases in tax rates, but that's no firm proof of causality.

And, just to be clear, I resist the notion that our goal should be to find that optimum tax rate that produces the highest government revenue (i.e. just as a physician shouldn't ask "How much can we bleed the patient each day to gain the greatest amount of blood over time--if we take too much he gets so sickly that output decreases." Our goal should be on the health of the patient--our people, and the private economy that sustains us).

|

I agree with your stated goal Sam. But there's enough arc between the 35% rate and the 50% rate on Art's curve to restore the lost revenues incurred with his rhetorical tools.

And you can add Alan Greenspan and David Stockman to Emeritus' list of libertarian heretics.

P.S. I think Mankiw called the notion "snake oil".

|

|

|

10-26-2010, 02:49 PM

10-26-2010, 02:49 PM

|

#156

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2004

Location: SW Ohio

Posts: 14,404

|

All I'm rebutting is the claim that "tax cuts don't pay for themselves". Sometimes they do (and have). Situation-specific details are crucial. The most important details: What's the present tax rate, and how long are you willing to wait?

Laffer's curve in generic form has no units. Situation-specific curves (with units) are always subject to lots of debate due to the underlying assumptions. View 'em with suspicion, but the underlying theory is well accepted. Does anyone think a 99% rate of taxation would produce more government revenue after 5 years than a 30% rate?

|

|

|

10-26-2010, 02:57 PM

10-26-2010, 02:57 PM

|

#157

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by samclem

All I'm rebutting is the claim that "tax cuts don't pay for themselves". Sometimes they do (and have). Situation-specific details are crucial. The most important details: What's the present tax rate, and how long are you willing to wait?

Laffer's curve in generic form has no units. Situation-specific curves (with units) are always subject to lots of debate due to the underlying assumptions. View 'em with suspicion, but the underlying theory is well accepted. Does anyone think a 99% rate of taxation would produce more government revenue after 5 years than a 30% rate?

|

I think that Russian communism was a trial of that.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

10-26-2010, 03:11 PM

10-26-2010, 03:11 PM

|

#158

|

|

Recycles dryer sheets

Join Date: Oct 2010

Location: In a van down by the river

Posts: 407

|

Quote: Quote:

Originally Posted by samclem

All I'm rebutting is the claim that "tax cuts don't pay for themselves". Sometimes they do (and have). Situation-specific details are crucial. The most important details: What's the present tax rate, and how long are you willing to wait?

Laffer's curve in generic form has no units. Situation-specific curves (with units) are always subject to lots of debate due to the underlying assumptions. View 'em with suspicion, but the underlying theory is well accepted. Does anyone think a 99% rate of taxation would produce more government revenue after 5 years than a 30% rate?

|

I don't think anyone disagrees that rates above a certain level are counter productive. But remember also we're not talking about a flat tax.

Marginal rates were as high as 90% during what I think was the greatest economic expansion in our history. I was around for some of it and don't recall any inordinate number of blood transfusions taking place.

|

|

|

10-26-2010, 03:39 PM

10-26-2010, 03:39 PM

|

#159

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2004

Location: SW Ohio

Posts: 14,404

|

Well, the last time the top bracket was above 90% was in 1963. President Kennedy recognized the damage being caused and pushed a cut in rates (the top rate was reduced from 91% to 70% by 1965)

Quote: Quote:

Our true choice is not between tax reduction, on the one hand, and the avoidance of large Federal deficits on the other. It is increasingly clear that no matter what party is in power, so long as our national security needs keep rising, an economy hampered by restrictive tax rates will never produce enough revenues to balance our budget just as it will never produce enough jobs or enough profits… In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now.

- President John F. Kennedy

|

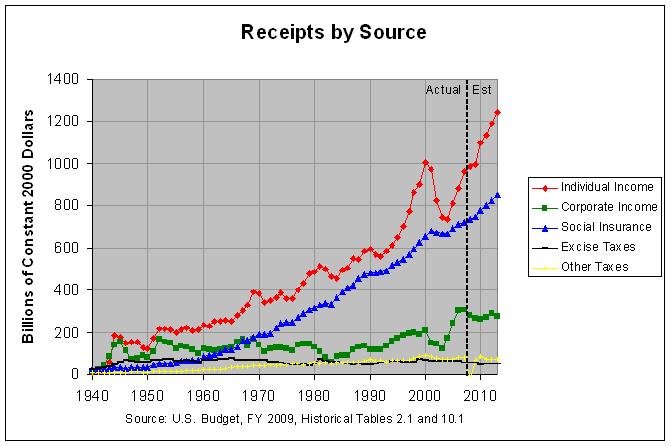

There was an increase in the slope of the revenues from the individual income tax beginning in 1965. That's not to say that the tax cuts caused it, of course.

And the slope of the revenue line increases after the Reagan tax cuts of 1984, but that's no proof that these cuts caused increased economic activity and more tax revenues.

There was another, probably coincidental, spike in revenues and continued upsurge after the "Bush tax cuts" of 2003. Again, that's not proof that the tax cuts caused it.

|

|

|

10-26-2010, 03:57 PM

10-26-2010, 03:57 PM

|

#160

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2005

Location: Lake Livingston, Tx

Posts: 4,204

|

I find it difficult to look at past tax rate, high or low, and draw conclusion that similar rates would do X today. The tax code today is a far cry from the tax code of the Kennedy or even Reagan era. Comparing a tax rate with out the accompanying deductions and exemptions, imo, does not work. Like wise comparing the tax rate without taking into consideration spending, and the status of government debt would appear to also be flawed.

__________________

If it is after 5:00 when I post I reserve the right to disavow anything I posted.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|