I am 39 years old and at this point don't expect a dime back from SS, and, despite the handy statements that I am sent regularly. For the good of all, I would be willing to continue to contribute some amount to pay for those who above a certain age who were "promised" benefits and will rely on them to live (sorry Mr. Gate and Mr. Buffett..you are out, as means testing is a great idea)

The bottom line for me is that I do not want the federal government having any part of my retirement planning or investing. I can find better, smarter, more efficient, and higher yielding options on my own.

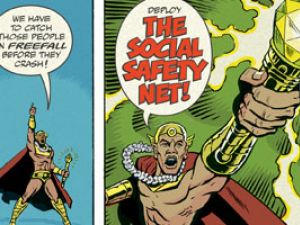

I will agree to pay a small tax into a "social security"-like fund that will provide for those that simply don't have enough money to take reasonable care of themselves.

I, morally, cannot demand that other people fund my retirement with their hard earned money. And, I cannot understand why anyone would willingly choose the federal government to manage their money for them (ex: see federal deficit & debt). How about this to make everyone happy, let the federal government's retirement program compete in the open market with all the other investment options and those that think it's the best can send in their money for handling

Again, it's an interesting debate and I continue to be surprised by all of those who think SS is a good program for us all....