Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

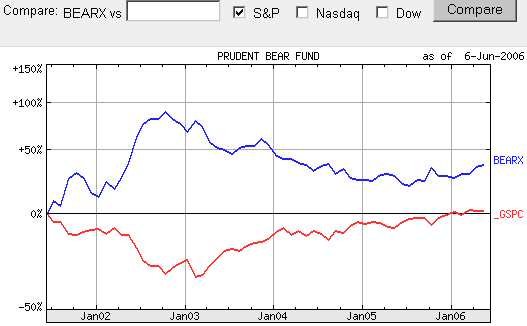

Here is an article from a guy who is adding this to his portfolio. Middleton states that some believe we may see the stock market decline by as much as 50% over the next 3 years. Anyone here believe that this is a good idea for added diversification? Seems to me you can get to the point that you have so many bases covered that you have very little chance for any overall gains.

http://articles.moneycentral.msn.com/Investing/MutualFunds/MakeaBearMarketBearable.aspx

http://articles.moneycentral.msn.com/Investing/MutualFunds/MakeaBearMarketBearable.aspx