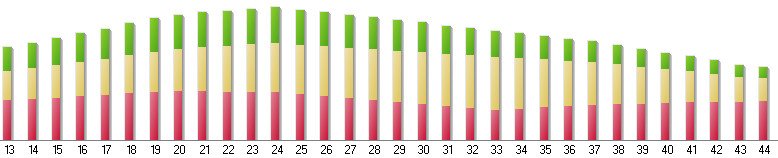

I think I am as confident with QLP as anything right now (remarkably, given my earlier problems with it), and have attached an updated chart, but my confidence in Fidelity RIP has been disrupted (because it

says that it handles income taxes but I don't see where that is the case, in the yearly tables it generates). I'm not sure what I can do to gain more confidence in FireCalc, other than to compare QLP to it and and determine whether QLP's projection fits comfortably within the range of possibilities that FireCalc outlines. As soon as I get Fidelity RIP straightened out in my head I'll post an update, including an updated chart for it, with the amounts removed, as above.

In QLP I've entered the following:

| Type of Account | Return Before Retirement | Return After Retirement |

| Taxable accounts: | 8% | 6% |

| My Tax-deferred: | 6% | 4% |

| Spouse Tax-deferred: | 6% | 4% |

| | |