NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

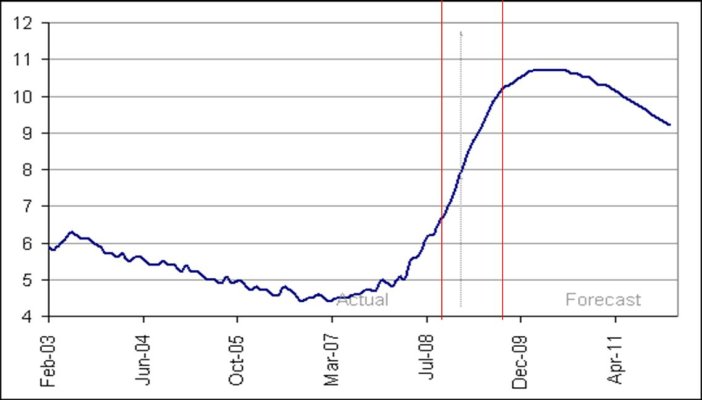

Robert J. Gordon, one of seven members of the elite Business Cycle Dating Committee of the National Bureau of Economic Analysis, said that unemployment has peaked, and we are starting to climb out of this hole. Details are at the link below.

At 55% equity, I am licking my chops to deploy some more cash. Buy, buy, buy, anyone?

So many stocks so cheap, so little guts! I am talking about myself of course, having seen a few women on this forum more gutsy than myself.

I am talking about myself of course, having seen a few women on this forum more gutsy than myself.

The recession? It's over, economist says - MSN Money

PS. In the FOMC minute released a couple of days earlier, it was mentioned that the Fed research staff believed that the US economy will recover later this year, rather than in 2010 as the committee itself thought. The TV reporter said that the research staff was probably better informed than the honcho bosses, and therefore should be taken more seriously.

At 55% equity, I am licking my chops to deploy some more cash. Buy, buy, buy, anyone?

So many stocks so cheap, so little guts!

The recession? It's over, economist says - MSN Money

PS. In the FOMC minute released a couple of days earlier, it was mentioned that the Fed research staff believed that the US economy will recover later this year, rather than in 2010 as the committee itself thought. The TV reporter said that the research staff was probably better informed than the honcho bosses, and therefore should be taken more seriously.

Last edited: