Rich_by_the_Bay

Moderator Emeritus

Interesting article on this topic.

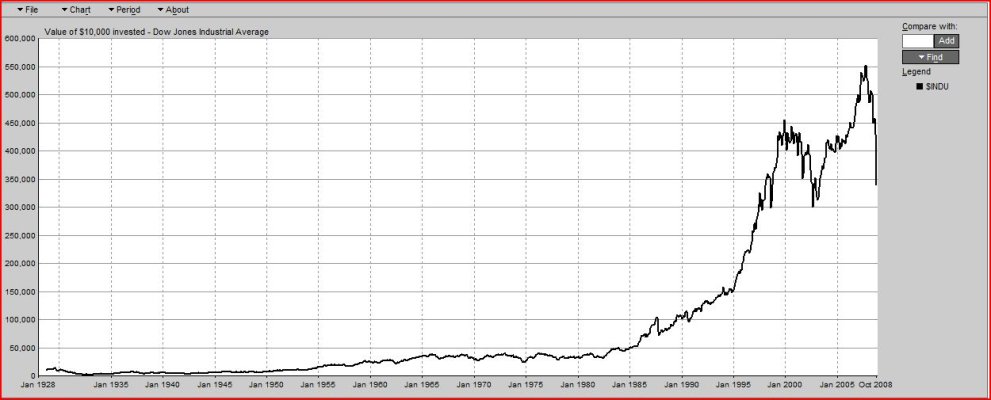

A 60:40 investor needed 10 years to reach the previous starting line. A full stock investor had only recovered 60% by then.

A 60:40 investor needed 10 years to reach the previous starting line. A full stock investor had only recovered 60% by then.