Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What US demand does isn't as infuential as it once was. Oil is a global commodity more than ever, even though we use way more than our "fair share" per capita, demand and pricing is global, including the BRICs among others. Though they don't consume like we do (yet), there are 9 times as many "capitas" in the BRIC countries vs the US.

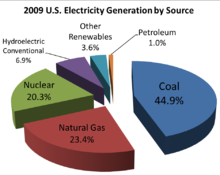

And some of the posts here seem to be mixing transportation energy (mostly oil) and power generation (not oil) in their arguments.

And some of the posts here seem to be mixing transportation energy (mostly oil) and power generation (not oil) in their arguments.

Last edited: