From living in retirement communities for 27 years I'd say the article is spot on.

We classify where we've lived as working man's communities, and I'd guess the average Investible Assets to be substantially below $1 million In fact wealth has had almost no part in our associations with the residents in the places we've chosen.

I suppose it's a matter of perception, but even retirement communities like The Villages, didn't hold much charm for us. Having a new golf cart, or dressing up for dinner or shopping was anethema. Not that there's anything at all wrong with that, but just not in our comfort zone.

That said, it seems there has always been a level of happiness that corresponds to the description of contentment in the article. The other part that I think was insightful, was the bit about "adaptation". We fell into this automatically, and it was very easy, since at the time we retired, we were anything but financially secure. We, like many others were early retirees taking a chance on "making it"... with the idea that at age 53, we could always go back.

I believe that, in large part, the selection of where and how to live, may be the most important factor for happiness. We have since looked at and have been able to afford more expensive lifestyles is we so chose, but the comfort of living and loving the life we have learned makes anything else, a no starter.

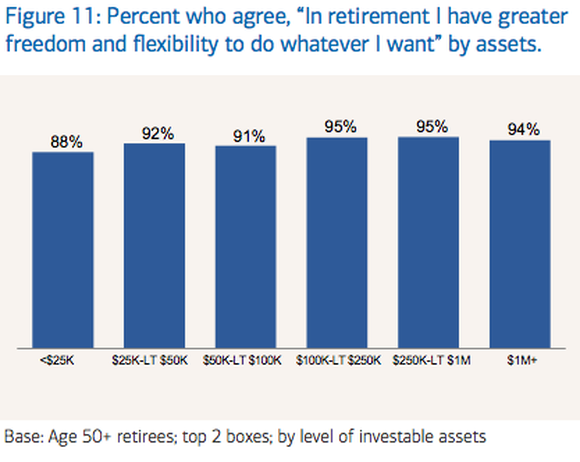

I respect that tiny One Percent difference attributed to the million dollar plus number... and look at it as the extra effort needed to maintain the portfolios and wealth related factors. IMHO, maybe not a negligible number.