Hard to say...

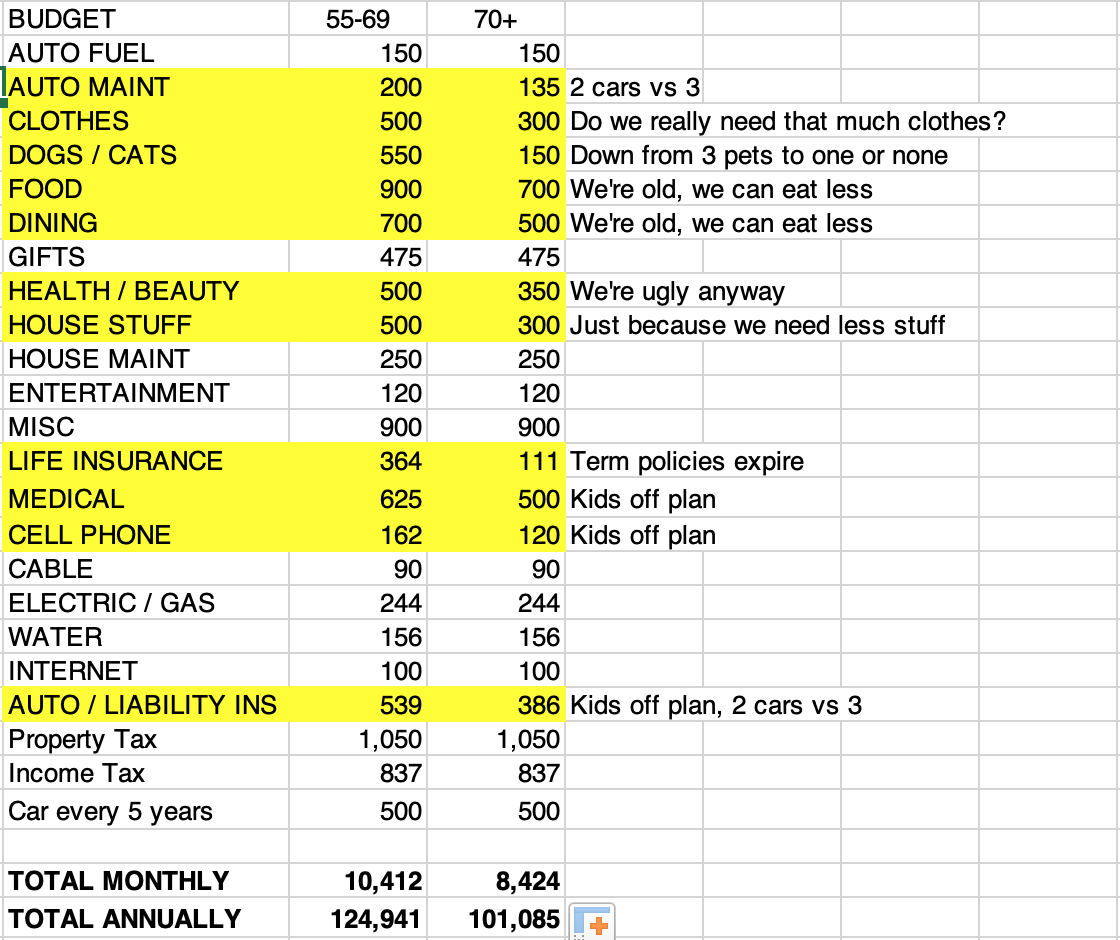

50-60 we will begin ER and face 3 kids completing college and expensive pre-medicaid insurance

60-70 likely we face some Weddings, Down payment help with kids and likely grandkids

70-80 We might finally have some time to travel, but with FULL SS, Pension, and likely inheritance we will have more than we need.

The future is bright.

50-60 we will begin ER and face 3 kids completing college and expensive pre-medicaid insurance

60-70 likely we face some Weddings, Down payment help with kids and likely grandkids

70-80 We might finally have some time to travel, but with FULL SS, Pension, and likely inheritance we will have more than we need.

The future is bright.