Souschef

Thinks s/he gets paid by the post

For those of us on Medicare, the ACA discussions about minimizing MAGI have no relevance, but is very important to ER's.

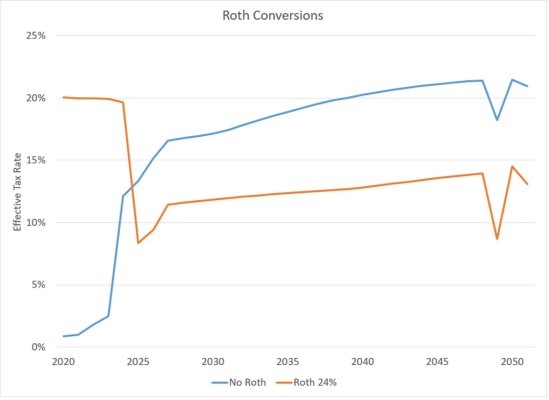

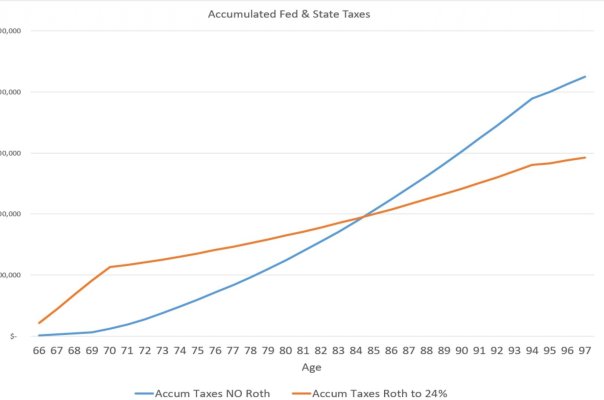

I have very little wiggle room as far as income due to SS, pension and RMD. which puts me in the 24% bracket.

I guess some would call that a "first world problem"

I have very little wiggle room as far as income due to SS, pension and RMD. which puts me in the 24% bracket.

I guess some would call that a "first world problem"