|

|

11-23-2015, 02:24 PM

11-23-2015, 02:24 PM

|

#101

|

|

gone traveling

Join Date: Sep 2013

Posts: 1,248

|

Quote: Quote:

Originally Posted by Walt34

Oh, absolutely agreed on that!

Every state isn't Illinois though. Some are actually fairly well run by generally honest people. It gets better at the city or county level where there is more citizen oversight over the details. Well, some of them anyway.

Generally I'd agree that one should behave as if a promised pension wasn't going to be there. That simply isn't possible for a lot of people though.

|

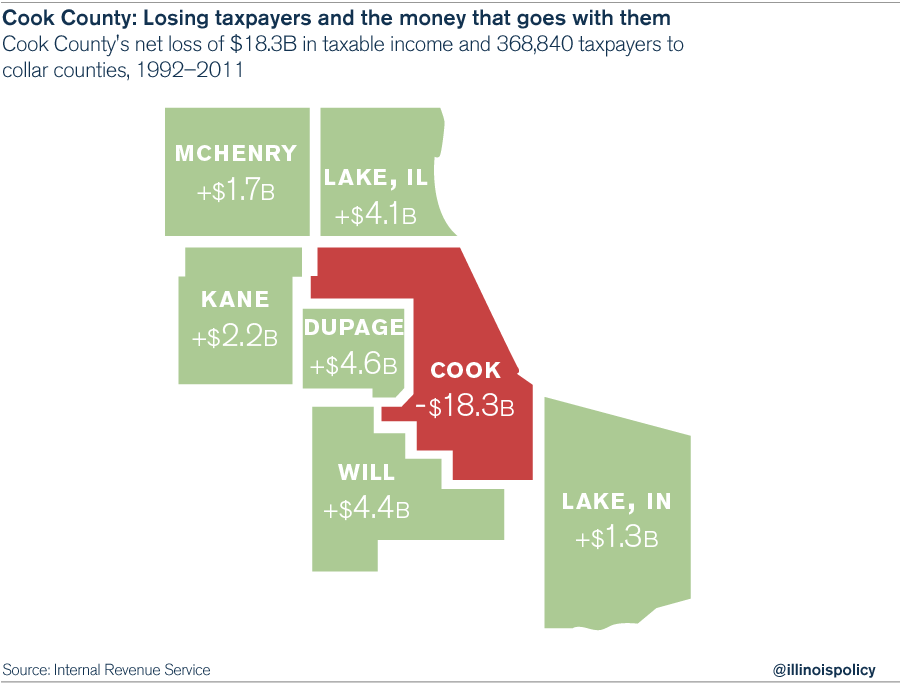

Illinois has declining population and one of the highest real estate taxes in US and more tax hikes coming soon  which may result in further exodus...

Probably warning sign.... one is better of working in public sector in prospering growing region of US.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

11-23-2015, 04:07 PM

11-23-2015, 04:07 PM

|

#102

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2013

Posts: 9,358

|

Quote: Quote:

Originally Posted by Jpg1717

We do not need to look up the cost of a private annuity. I do not need an annuity . I have a pension. I thought this was an online early retirement community? Why are some people criticizing their fellow members of this community whom chose to reach early retirement by putting their lives on the line,protecting their fellow citizens for 30 years,and retiring with a pension?

|

You quoted my post, which did not criticize pensions. I just stated what many were worth, which is simply a fact, not an opinion. ERD50 said many here with public pensions are millionaires. The net present value of more than a few of the public pensions mentioned in these forums are worth 7 figures. These pensions, if taken as lump sums instead of annuities, would be worth $1M+. The lower the interest rate the higher the lump sum value, and interest rates are historically pretty low right now.

Whether they have a beneficiary value is irrelevant, as there are commercial products available that can be turned into similar annuities with no beneficiary value. If those commercial single annuities with no beneficiary income would cost 7 figures to buy, then that is the fair market value of the equivalent public pension taken as an annuity.

__________________

Even clouds seem bright and breezy, 'Cause the livin' is free and easy, See the rat race in a new way, Like you're wakin' up to a new day (Dr. Tarr and Professor Fether lyrics, Alan Parsons Project, based on an EA Poe story)

|

|

|

11-23-2015, 04:13 PM

11-23-2015, 04:13 PM

|

#103

|

|

Full time employment: Posting here.

Join Date: Apr 2015

Posts: 903

|

Quote: Quote:

Originally Posted by eta2020

Probably warning sign.... one is better of working in public sector in prospering growing region of US.

|

Or, you know, just work for the Feds.

Quote: Quote:

Originally Posted by Walt34

Generally I'd agree that one should behave as if a promised pension wasn't going to be there. That simply isn't possible for a lot of people though.

|

Alas, this is a bit more difficult when you're only making $40-80K a year (minus mandatory pension contributions) and work in HCOL area where housing+transportation already consumes a good portion of your budget.

Quote: Quote:

Originally Posted by youbet

That's what I was thinking. And, if that's the case, all the more reason for prospective new Illinois employees to want to be on SS, even if it means dropping the current Tier II pension. Then they'd have their salary plus SS, period. No pension. No matching. No profit sharing. No stock options. No bonuses. It would be easy to understand the true value of your compensation. The state could set wages to attract and retain who they want. Employees could accept the simple terms (salary + SS and nothing else, nothing) or not. Employees could also leave if a more attractive situation presents itself leaving nothing behind. Everything they earned would be in their pocket when they walked out the door.

|

I'm not sure how easy that's gonna be for government agencies. Hiring is a bureaucratic nightmare. When a position opens, it probably takes maybe 2 or more years to fill. With the current system, it's a lot easier to keep current employees by way of holding pension hostage than it is to hire new ones. They're gonna have to change hiring policies if they switch to a model based purely on salary/wage.

Quote: Quote:

Originally Posted by youbet

The failure of Illinois to fund the pension system is notorious so I'll not beat a dead horse. But the current 40%+ level of funding is representative of the state having contributed (or contributed and borrowed back) a net of nothing. The funding level is about what it would have been if the employee 9.5% was the only inflow. Now they want to cut the pensions of people who generally funded their own pensions 100%.

|

Interesting. I did the math for a hypothetical $50K salary, 2.5% COLA while working, no promotions, 30 years service credit and historical 20-year annualized investment returns for our pension system (30-year annualized returns were 2% higher so I just used 20) and you're right about the 40% being funded solely by employee contributions.

Of course, the way the system often works is your pension is taken 100% from your own contributions first and when that runs out, that's the only time you start dipping into the trust fund.

|

|

|

11-23-2015, 04:34 PM

11-23-2015, 04:34 PM

|

#104

|

|

gone traveling

Join Date: Sep 2013

Posts: 1,248

|

Quote: Quote:

Originally Posted by Jpg1717

Ziggy29- Great analysis. The fact is that an individual with a pension is not truly a "millionaire" because when he dies his children are not left with a million.A person withdrawing 3.5% of a million annually will be able to still leave an estate of one million. As you said- apples and oranges.I have learned a lot from this forum, although I do not feel welcome as a member of this community because of some of the earlier comments (ie High School grads getting large pensions).

|

I was a person who made first reference to the fact that in some municipalities you have High School Grads getting 130k pension benefits in their 50s.

Sorry if I offended anybody about it. It is matter of fact.

I have no objections to man and women serving in our Armed Forces who spend decade in Iraq and Afghanistan having their pensions. They deserve it!!!!!

I do think that 130k pension for Firefighter in LA makes no sense. But if we have tax payers willing to pay 20k in Real Estate taxes to fund this then it will go on. If you are firefighter in Palo Alto you have nothing to worry even about 200k pension  . This is how capitalism works.

So if you seek public employment ...location, location, location.

|

|

|

11-23-2015, 04:39 PM

11-23-2015, 04:39 PM

|

#105

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Really? Since about 1983, new hires with the federal government have been under FERS, not CSRS. And I can assure you that new hires in FERS are not getting a sweetheart deal. FERS employees get 1% of high-3 pay per year of service, and new FERS hires (myself included) pay 4.4% of their check into that pension plan.

Yeah, CSRS retirement more closely resembled the sweetheart deals that still exist in a few state and local governments today. But only those who have been working for Uncle Sam for 35+ years are getting that great deal. The federal government was way ahead of state and local governments in terms of reining in unsustainable pension plans and finding a sustainable model which mirrors the "three-legged stool" approach to retirement.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

11-23-2015, 04:39 PM

11-23-2015, 04:39 PM

|

#106

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2009

Posts: 9,343

|

Quote: Quote:

Originally Posted by daylatedollarshort

You quoted my post, which did not criticize pensions. I just stated what many were worth, which is simply a fact, not an opinion. ERD50 said many here with public pensions are millionaires. The net present value of more than a few of the public pensions mentioned in these forums are worth 7 figures. These pensions, if taken as lump sums instead of annuities, would be worth $1M+. The lower the interest rate the higher the lump sum value, and interest rates are historically pretty low right now.

Whether they have a beneficiary value is irrelevant, as there are commercial products available that can be turned into similar annuities with no beneficiary value. If those commercial single annuities with no beneficiary income would cost 7 figures to buy, then that is the fair market value of the equivalent public pension taken as an annuity.

|

Pensioner here....Maybe I have been on this forum too long as these discussions have been had a few times. I never thought of them being in a divisive manner or critical. Just a "numbers" comment. In fact I remember the first one I read when I was about to retire 6 years ago. I was excited to find out I was a "millionaire". Because it wasn't happening anytime soon from what was in my personal accounts.

Sent from my iPad using Tapatalk

|

|

|

11-23-2015, 04:41 PM

11-23-2015, 04:41 PM

|

#107

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Quote: Quote:

Originally Posted by eta2020

I do think that 130k pension for Firefighter in LA makes no sense. But if we have tax payers willing to pay 20k in Real Estate taxes to fund this then it will go on. If you are firefighter in Palo Alto you have nothing to worry even about 200k pension  . This is how capitalism works. |

I have trouble believing this can happen without massive pension spiking with overtime. Pensions aren't the problem as much as the ability to abuse the system is.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

11-23-2015, 04:44 PM

11-23-2015, 04:44 PM

|

#108

|

|

gone traveling

Join Date: Sep 2013

Posts: 1,248

|

Quote: Quote:

Originally Posted by Mulligan

Pensioner here....Maybe I have been on this forum too long as these discussions have been had a few times. I never thought of them being in a divisive manner or critical. Just a "numbers" comment. In fact I remember the first one I read when I was about to retire 6 years ago. I was excited to find out I was a "millionaire". Because it wasn't happening anytime soon from what was in my personal accounts.

Sent from my iPad using Tapatalk |

Yea we had fight to see whose millions are better your or mine

Then we became friends

|

|

|

Risk Factor for Public Pensions?

11-23-2015, 04:55 PM

11-23-2015, 04:55 PM

|

#109

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2009

Posts: 9,343

|

Risk Factor for Public Pensions?

I am agnostic on it now....But my GF would definitely side with you! As we are in a tough spot, and this is the drawbacks of pensions in my situation. She could retire very soon. But if she quit and I died relatively soon afterwards she would be screwed without my pension. So she almost has to go another 10 to lock in future pension and maximize SS. Still should be able to get her out at 58, which is 10 years away. But that means she will have to put up with watching her BF do nothing for 16 years while she continued working.

Sent from my iPad using Tapatalk

|

|

|

11-23-2015, 05:02 PM

11-23-2015, 05:02 PM

|

#110

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Frankly I'm a fan of the three-legged stool concept of retirement. The biggest problem today, IMO, is that pensions are so back-loaded that unless you stay with one employer for 20+ years, or more, you get almost nothing out of that leg. I'd love to see a way to make a "portable pension" a reality, but not sure how it could happen.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

11-23-2015, 05:08 PM

11-23-2015, 05:08 PM

|

#111

|

|

Full time employment: Posting here.

Join Date: Apr 2015

Posts: 903

|

Quote: Quote:

Originally Posted by ziggy29

Really? Since about 1983, new hires with the federal government have been under FERS, not CSRS. And I can assure you that new hires in FERS are not getting a sweetheart deal. FERS employees get 1% of high-3 pay per year of service, and new FERS hires (myself included) pay 4.4% of their check into that pension plan.

Yeah, CSRS retirement more closely resembled the sweetheart deals that still exist in a few state and local governments today. But only those who have been working for Uncle Sam for 35+ years are getting that great deal. The federal government was way ahead of state and local governments in terms of reining in unsustainable pension plans and finding a sustainable model which mirrors the "three-legged stool" approach to retirement.

|

In fairness, that's 1% + SS for FERS and there's also a TSP match. I wasn't trying to imply Federal pension was a sweetheart deal. Just that as far as pension "safety" is concerned, Uncle Sam is more likely to pay out than severely underfunded state and local government retirement systems.

|

|

|

11-23-2015, 05:17 PM

11-23-2015, 05:17 PM

|

#112

|

|

gone traveling

Join Date: Sep 2013

Posts: 1,248

|

Quote: Quote:

Originally Posted by Mulligan

I am agnostic on it now....But my GF would definitely side with you! As we are in a tough spot, and this is the drawbacks of pensions in my situation. She could retire very soon. But if she quit and I died relatively soon afterwards she would be screwed without my pension. So she almost has to go another 10 to lock in future pension and maximize SS. Still should be able to get her out at 58, which is 10 years away. But that means she will have to put up with watching her BF do nothing for 16 years while she continued working.

Sent from my iPad using Tapatalk |

That is what happens when you get a young girlfriend

|

|

|

11-23-2015, 05:20 PM

11-23-2015, 05:20 PM

|

#113

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by ziggy29

Really? Since about 1983, new hires with the federal government have been under FERS, not CSRS. And I can assure you that new hires in FERS are not getting a sweetheart deal. FERS employees get 1% of high-3 pay per year of service, and new FERS hires (myself included) pay 4.4% of their check into that pension plan...

|

That's not too shabby compared to SS. I just pulled up my SS income record for 33 years of work, and found out that I would have more under FERS than what I will get from SS. And I contributed 6.2% (not counting employer's share), not 4.4%.

Oh wait. SS earliest retirement age is 62. For FERS, at 62 one would get 1.1% for each year of service, not 1%. So, FERS would be better for me. At 62, FERS would be about 56% higher.

PS. Note that FERS scales up with income, while SS benefit is absolutely not proportional to income.

PPS. I used SS capped income, not gross income, in the above FERS estimate.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

11-23-2015, 05:29 PM

11-23-2015, 05:29 PM

|

#114

|

|

Recycles dryer sheets

Join Date: Oct 2013

Posts: 265

|

Quote: Quote:

Originally Posted by eta2020

Illinois has declining population and one of the highest real estate taxes in US and more tax hikes coming soon  which may result in further exodus...

Probably warning sign.... one is better of working in public sector in prospering growing region of US. |

To see the future of Illinois I'd argue look at Cook County. For years there has been population decline, or somewhat uneven seesawing between decline and slow growth, in both the city itself and Cook County. This may not be the greatest source for information (source typically leans to the right but putting that aside...) it speaks volume to how people react to higher taxes in areas where they can still access the jobs (albeit now with an hour long train commute into the city instead). I don't know the solution for Illinois/Chicago towards fixing everything but continually increasing taxes only works to a degree before people vote with their feet...

|

|

|

11-23-2015, 05:49 PM

11-23-2015, 05:49 PM

|

#115

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2009

Posts: 9,343

|

Only 4 years younger...that isn't bad...I was just a young retiree!

Sent from my iPad using Tapatalk

|

|

|

11-23-2015, 05:55 PM

11-23-2015, 05:55 PM

|

#116

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2006

Posts: 2,288

|

Quote: Quote:

Originally Posted by ziggy29

I have trouble believing this can happen without massive pension spiking with overtime. Pensions aren't the problem as much as the ability to abuse the system is.

|

Amen to that. Also, someone already pointed out that the $130K includes health benefits. I doubt there are many, if any, LA firefighters collecting $130K in cash benefits every year.

Besides it doesn't matter what the subject is, from welfare to a tax deductions, we can all search and find someone somewhere who is abusing the system. That doesn't mean the entire system is broken. The vast majority of people collecting public pensions are not collecting anywhere near that number and they have to stay with the same employer just about their entire working life even if they hate working there just to collect much of anything. There are so many reasons NOT to work as a public servant that once someone actually pulls it off and starts collecting we should not be making them feel guilty about it.

|

|

|

11-23-2015, 06:01 PM

11-23-2015, 06:01 PM

|

#117

|

|

Full time employment: Posting here.

Join Date: Apr 2015

Posts: 903

|

Quote: Quote:

Originally Posted by eta2020

I do think that 130k pension for Firefighter in LA makes no sense. But if we have tax payers willing to pay 20k in Real Estate taxes to fund this then it will go on. If you are firefighter in Palo Alto you have nothing to worry even about 200k pension  . This is how capitalism works.

So if you seek public employment ...location, location, location. |

I checked LA Fire and Police Pension. Average monthly pension for 2013-14 is $5,247. Out of 12,502 pensioners (I believe this includes disability and survivors), less than 10% receive pension of $100+K (likely chiefs, captains, etc). There is a total of 253 pensioners (~2%) collecting more than $10,000 per month. I haven't averaged out the monthly health and dental benefits but maximum medical subsidy is $1,344/mo or $16,133/yr. I guess that's not quite as catchy in the news, though, and wouldn't generate as much outrage.

Quote: Quote:

Originally Posted by ziggy29

I have trouble believing this can happen without massive pension spiking with overtime. Pensions aren't the problem as much as the ability to abuse the system is.

|

According to the LAFPP Summary Plan Description, overtime is not counted for calculating pension so can't really use OT to spike pension.

|

|

|

11-23-2015, 06:19 PM

11-23-2015, 06:19 PM

|

#118

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2009

Posts: 9,343

|

I don't think the long term safety of pensions isn't endangered by some forum members assigning mathematical values to a pension. Its going to be when the next generation who doesn't have any money needs to retire as private pensions are fading fast. This wont be a question of whether the pension is deserved or they pi$$ed all their money away and should have been saving better. It is going to be the few having something the many don't. In other words "the perception". Right or wrong, funded or not, deserved or not Im afraid eventually it could be framed on just perception.

Sent from my iPad using Tapatalk

|

|

|

11-23-2015, 07:00 PM

11-23-2015, 07:00 PM

|

#119

|

|

Full time employment: Posting here.

Join Date: Apr 2015

Posts: 903

|

Quote: Quote:

Originally Posted by Mulligan

Its going to be when the next generation who doesn't have any money needs to retire as private pensions are fading fast. This wont be a question of whether the pension is deserved or they pi$$ed all their money away and should have been saving better. It is going to be the few having something the many don't. In other words "the perception". Right or wrong, funded or not, deserved or not Im afraid eventually it could be framed on just perception.

|

Unfortunate but quite likely. It seems like it's already starting now.

Sad thing is 401k plans are like the wild, wild west. There are some good ones but plenty of bad ones. Instead of myRA, Obama would have done better opening TSP to everyone.

|

|

|

11-23-2015, 07:33 PM

11-23-2015, 07:33 PM

|

#120

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,242

|

Quote: Quote:

Originally Posted by youbet

Yes, lots of folks here have private pensions. Someone who worked for the MegaCorp I toiled at and was, say, a white collar professional of some type (It, engineering, finance, etc.) did very well. A DB pension. Generous profit sharing and 401k matching. Stock options. Company contribution to their SS. Retiree medical. Other ongoing benefits. Many of these have been dropped or reduced for the younger crowd but for those at or nearing retirement today, it was a pretty sweet deal. Oh, we all like to think of ourselves as the underdog, but your cash balance pension and company contribution towards your SS alone puts you out of the "sympathy range." If you get any kind of 401k match and/or retiree med benefits, you're in sweet shape.

|

I was not looking for sympathy.... but the difference in a pension from a gvmt agency and what I can get is night and day... If I wait until I am 65 and get an annuity with DW, my cash balance will provide me $450 per month... one of my sisters gets $5,400, another gets $4,000 and even my mom who worked only 11 years and retired 35 years ago get $1700... All three also get SS, so that is a wash....

Just as an FYI, I had 15 years at this mega... my time at a previous one did not yield much money.... a few thousand dollars....

Hmmmm, I wonder how much match I have received over the years.... that would be an interesting number to know.... wonder if I can figure it out or not...

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|