NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

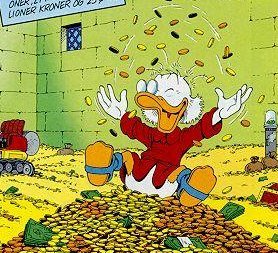

Well, I do not gloat about NW to any relative and friend, and only "hint" about it here. But at the end of the month, after my wife has paid all bills and I have to refill the checking account, all I see is money outflow.I include my home's value in my net worth when I'm bragging, but for retirement planing, I exclude it.

However, Meadbh is right. NW does include everything, meaning RE, and also my cars and the RV no matter how little they're worth. Investable assets are a retiree's lifeblood however, and the other "stuff" does not really add but draw from them.

Last edited: