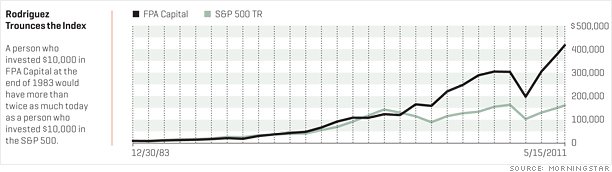

A long but interesting article about Bob Rodriguez's views of current market. This is the same contrarian who predicted tech bubble and 2008 mkt collapse.

Bob Rodriguez: The man who sees another crash - The Term Sheet: Fortune's deals blog Term Sheet

A quick summary is that he is not putting much money into bonds these days and has a large amt of fund invested in cash.

Most of know that Nat'l debt problem is going to have enormous consequences but if it's not bonds, what are safe alternatives? As a 46 getting ready to FIRE next year, choices have to be well thought out.

Bob Rodriguez: The man who sees another crash - The Term Sheet: Fortune's deals blog Term Sheet

A quick summary is that he is not putting much money into bonds these days and has a large amt of fund invested in cash.

Most of know that Nat'l debt problem is going to have enormous consequences but if it's not bonds, what are safe alternatives? As a 46 getting ready to FIRE next year, choices have to be well thought out.