Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

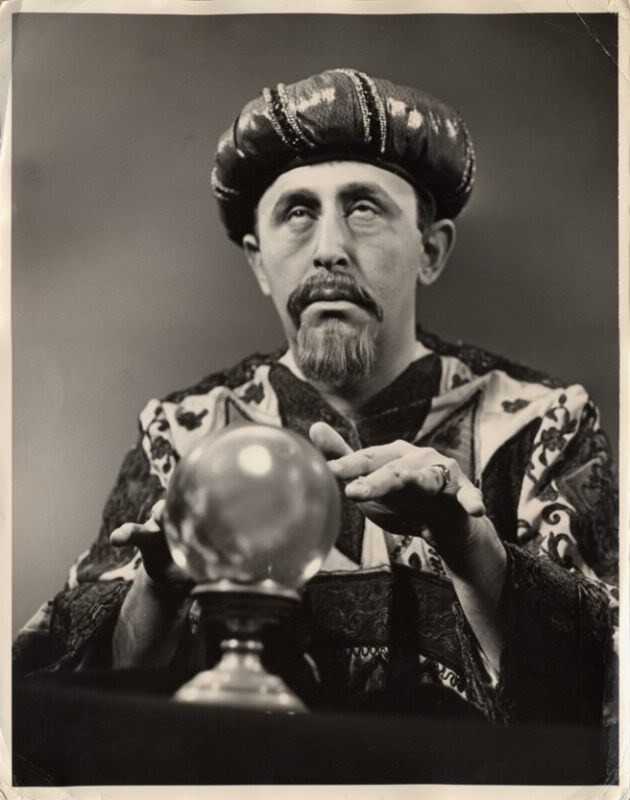

This morning I spent an hour in intense concentration as I tried to read the minds of the Fed Chair and the Central Bankers in Europe. Nothing but blank thoughts. So, I brought out my Crystal Ball, but it is cracked and the magical 'ether' inside has escaped. Finally, I decided to play my trump card and fired up my Time Machine. Alas, it is broken and the part it needs won't be made until 2347. So, I can't help answer the question.