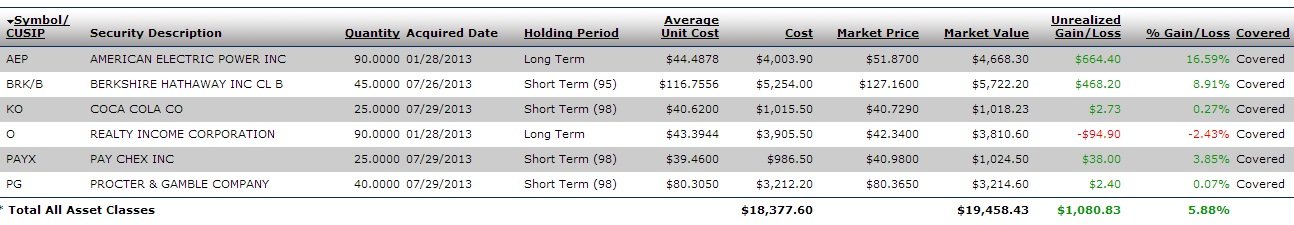

I have these few individual stocks in one of my brokerage accounts. I'm thinking of selling them all and moving the money into my Vanguard account that is almost all VTSAX and VIMAX.

A couple of these are long term, other's short term. However, the net gain is so little I'm thinking of just selling and moving them all in one shot. Does that sound reasonable?

A couple of these are long term, other's short term. However, the net gain is so little I'm thinking of just selling and moving them all in one shot. Does that sound reasonable?