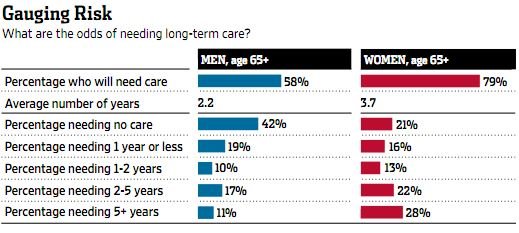

I was surprised at the chart showing 58% of men and 79% of women over age 65 will need long term care. This is much higher risk than I expected, especially for women.

I wondered about that also. It seems really high. Also, as mentioned, the percentage of women needing more than 5 years of care seems very high.

Here is a link to the article that came up with those numbers.

http://tinyurl.com/mzdg7sk

I haven't read it closely but it appears to be a prediction about the expected LTC nears for the current cohort of 65 year olds. LTC is defined to include facility care, formal home care, and informal care at home. The numbers are really different when you drill down to nursing home care.

SO this is article is apparently the care needs they anticipate not an actual statement of what is occurring or has occurred. They do say that they believe the current cohort of 65 year olds will have an average LTC need (as defined above) of 3 years.

They do project 79% of women needing LTC and 28% needing more than 5 years. They define LTC needs as based upon a moderate level of disability rather than a more restrictive need of LTC. For example, they use 1 or more ADL limitations while I think most long term policies use 2 or more.

If they use the more restrictive definition then the average length of LTC falls from 3 years (using the moderate definition) to 2.2 years using the more restrictive definition.

The model predicts that 2/3 of years of moderate LTC need will be spent at home. So for 65 year olds (in 2005 apparently when this was done), they predict average years of care at 3 years but only .8 years in nursing facilities and .3 years in assisted living. Of those receiving care, they project 35% using nursing facilities.

The average out of pocket LTC expenditures they estimate for those not on Medicaid is only $38,600. They do say that 6% will incur costs with a present value of $100,000 or more.

Anyway, the point is that the WSJ doesn't really explain that the chart is a model based upon projections and that it isn't just people needing nursing home or paid for care, but includes a much wider group of people with moderate care needs.