UnrealizedPotential

Thinks s/he gets paid by the post

- Joined

- May 21, 2014

- Messages

- 1,390

In that case, would they have not completely run out of money years earlier if they took it later? Sounds like they needed it for living expenses....And that they still have some assets today, as they took it early.

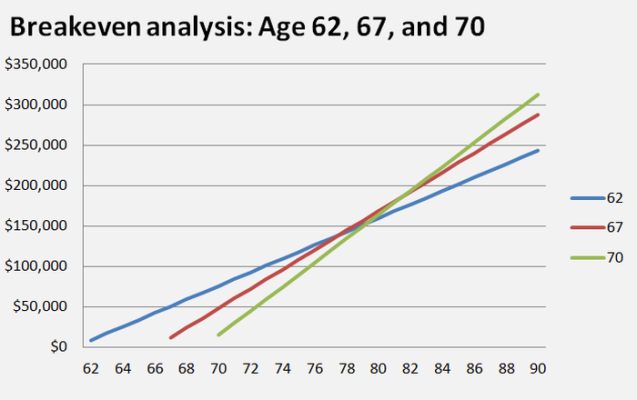

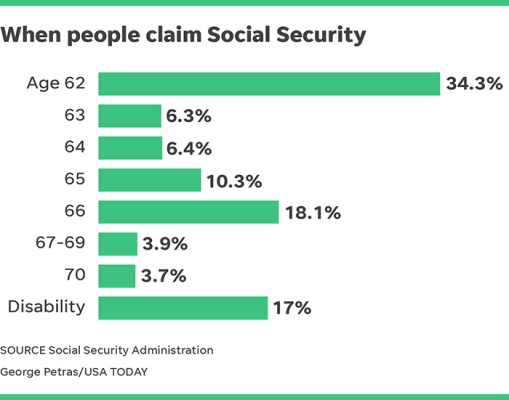

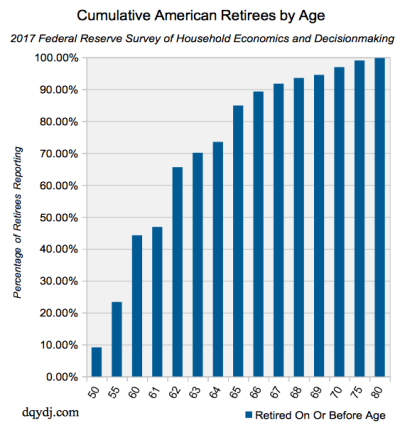

There's been no consensus on whether taking SS early is right or wrong on this board as far as I can tell. But I will tell you that living longer than expected is a real thing for many people. I see waiting to take SS as insurance against living longer. Now if one is very wealthy and the extra money isn't needed then it doesn't matter.

But the fact is for all too many individuals who collect SS who are not wealthy, and I dare say there are many who possibly suspect they are wealthier than they really are, they could make a big mistake by collecting it early. It would be a real concern of making the mistake of taking SS early and then realizing years later they should have waited.

Now some people can't wait to collect SS for a variety of reasons. I understand that. But for those who can and choose to collect early anyway and then realize they were not as well off as they thought, that is my concern. I believe there are a whole lot of people who fall into that category. I am not here to say that collecting SS is wrong in all cases at 62, it is just that I think there are a lot of people who could have waited but didn't and it was a mistake later in life as they lived longer and could no longer keep up with inflation.

Last edited: