Helena

Full time employment: Posting here.

- Joined

- Aug 27, 2006

- Messages

- 994

.

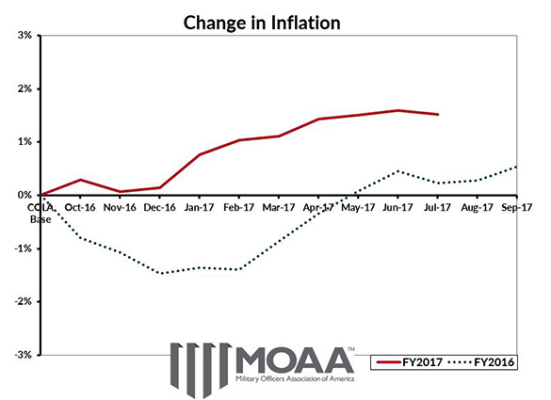

Big Social Security COLA will be offset by Medicare premiums

" For a retiree receiving the average monthly Social Security benefit of $1,360, a 2 percent raise would translate to an increase of $27.20. But for most beneficiaries, Medicare Part B premiums are deducted from Social Security. And the impact of the Part B premium on net benefits next year will vary due to what is known as the “hold harmless” provision governing Social Security.

By law, the dollar amount of Part B premium increases cannot exceed the dollar amount of the COLA — a feature that ensures net Social Security benefits do not fall. The hold harmless provision applies to the 70 percent of the Medicare population enrolled in both programs. Those not held harmless include anyone delaying their filing for Social Security benefits, but others affected include some federal and state government retirees. Affluent seniors who pay high-income Medicare premium surcharges also are not protected.

The stingy COLAs of the past two years are rare, and now they have set the table for an equally unusual situation for 2018.

The recent flat COLAs meant that nonprotected Medicare enrollees shouldered most of the burden of rising Part B premiums; the premiums for this group jumped sharply in 2016 and 2017. This year, they are paying $134 per month, while protected beneficiaries are paying an average of $109.

But a generous 2018 COLA will spread higher Part B program costs across the entire Medicare population. That means nonprotected enrollees will see their premiums fall, while the protected group will pay more. "

more at link

Big Social Security COLA will be offset by Medicare premiums | Business | stltoday.com

.

Big Social Security COLA will be offset by Medicare premiums

" For a retiree receiving the average monthly Social Security benefit of $1,360, a 2 percent raise would translate to an increase of $27.20. But for most beneficiaries, Medicare Part B premiums are deducted from Social Security. And the impact of the Part B premium on net benefits next year will vary due to what is known as the “hold harmless” provision governing Social Security.

By law, the dollar amount of Part B premium increases cannot exceed the dollar amount of the COLA — a feature that ensures net Social Security benefits do not fall. The hold harmless provision applies to the 70 percent of the Medicare population enrolled in both programs. Those not held harmless include anyone delaying their filing for Social Security benefits, but others affected include some federal and state government retirees. Affluent seniors who pay high-income Medicare premium surcharges also are not protected.

The stingy COLAs of the past two years are rare, and now they have set the table for an equally unusual situation for 2018.

The recent flat COLAs meant that nonprotected Medicare enrollees shouldered most of the burden of rising Part B premiums; the premiums for this group jumped sharply in 2016 and 2017. This year, they are paying $134 per month, while protected beneficiaries are paying an average of $109.

But a generous 2018 COLA will spread higher Part B program costs across the entire Medicare population. That means nonprotected enrollees will see their premiums fall, while the protected group will pay more. "

more at link

Big Social Security COLA will be offset by Medicare premiums | Business | stltoday.com

.