BigNick

Thinks s/he gets paid by the post

Since the start of the year, the market hasn't done too badly. So why is my portfolio - in Euros - flat?

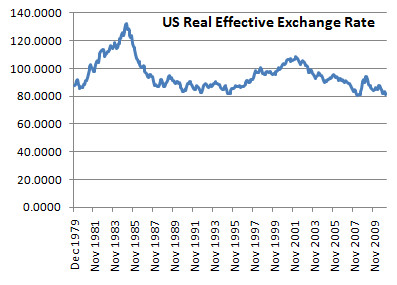

I guess it could have something to do with this:

Half my portfolio is outside the Euro zone, and while not every currency has dropped as much as the USD, the Euro has certainly been very strong. I reckon I'd be 5% better off overall if the two had been stable since Jan 1. Grrr.

Still, "make lemonade" and all that: I will probable be visiting the US at least once and maybe twice this year, so I can afford a nicer hotel.

I guess it could have something to do with this:

Half my portfolio is outside the Euro zone, and while not every currency has dropped as much as the USD, the Euro has certainly been very strong. I reckon I'd be 5% better off overall if the two had been stable since Jan 1. Grrr.

Still, "make lemonade" and all that: I will probable be visiting the US at least once and maybe twice this year, so I can afford a nicer hotel.