|

|

Someone please bump the dollar (or cap the Euro)!

05-02-2011, 06:11 AM

05-02-2011, 06:11 AM

|

#1

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2010

Location: Palma de Mallorca

Posts: 1,419

|

Someone please bump the dollar (or cap the Euro)!

Since the start of the year, the market hasn't done too badly. So why is my portfolio - in Euros - flat?

I guess it could have something to do with this:

Half my portfolio is outside the Euro zone, and while not every currency has dropped as much as the USD, the Euro has certainly been very strong. I reckon I'd be 5% better off overall if the two had been stable since Jan 1. Grrr.

Still, "make lemonade" and all that: I will probable be visiting the US at least once and maybe twice this year, so I can afford a nicer hotel.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

05-02-2011, 07:56 AM

05-02-2011, 07:56 AM

|

#2

|

|

Recycles dryer sheets

Join Date: Mar 2011

Location: Brooklyn, NY

Posts: 197

|

Fed needs to start raising interest rate despite the worries of economic recovery. If not, we are going to have another late 70's and early 80's inflation horror. Two simple steps to raising value of dollar which will not happen.

1. Stop printing money

2. Raise interest rate

But it won't happen because with people's money in the bank losing value, government pays debt with lower value than when it borrowed.

__________________

The time to take counsel of your fears is before you make an important battle decision. That’s the time to listen to every fear you can imagine! When you have collected all the facts and fears and made your decision, turn off all your fears and go ahead! – General George S. Patton

|

|

|

05-02-2011, 08:08 AM

05-02-2011, 08:08 AM

|

#3

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,699

|

Quote: Quote:

Originally Posted by BigNick

Since the start of the year, the market hasn't done too badly. So why is my portfolio - in Euros - flat?

I guess it could have something to do with this:

Half my portfolio is outside the Euro zone, and while not every currency has dropped as much as the USD, the Euro has certainly been very strong. I reckon I'd be 5% better off overall if the two had been stable since Jan 1. Grrr. |

True, but you still have accessible and affordable health care.

__________________

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.”

― Rudiger Dornbusch

|

|

|

05-02-2011, 05:01 PM

05-02-2011, 05:01 PM

|

#4

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2010

Location: midwestern city

Posts: 4,061

|

I would not be surprised if 1 euro = $2 by 2015.

__________________

Very conservative with investments. Not ER'd yet, 48 years old. Please do not take anything I write or imply as legal, financial or medical advice directed to you. Contact your own financial advisor, healthcare provider, or attorney for financial, medical and legal advice.

|

|

|

05-02-2011, 06:14 PM

05-02-2011, 06:14 PM

|

#5

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2003

Location: Pasadena CA

Posts: 3,345

|

Since oil is pretty much priced in dollars it ought to make living in Europe and other places whose currency is improving cheaper places to live.

__________________

T.S. Eliot:

Old men ought to be explorers

|

|

|

05-03-2011, 08:09 AM

05-03-2011, 08:09 AM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2004

Posts: 1,433

|

Quote: Quote:

Originally Posted by BigNick

Since the start of the year, the market hasn't done too badly. So why is my portfolio - in Euros - flat?

I guess it could have something to do with this:

Half my portfolio is outside the Euro zone, and while not every currency has dropped as much as the USD, the Euro has certainly been very strong. I reckon I'd be 5% better off overall if the two had been stable since Jan 1. Grrr.

Still, "make lemonade" and all that: I will probable be visiting the US at least once and maybe twice this year, so I can afford a nicer hotel.  |

Does this make you feel better?

SINGER$MARKET: Annotated US Dollar Index - $USD - Monthly - Cash

|

|

|

05-03-2011, 09:47 AM

05-03-2011, 09:47 AM

|

#7

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2005

Posts: 4,391

|

If you measure the (US) market in Euros or $AUD then the market is flat or actually declining.

The gains in the Dow and S$P500 make us feel better but in terms of purchasing power the gains just may be illusory.

|

|

|

05-03-2011, 11:54 AM

05-03-2011, 11:54 AM

|

#8

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2010

Location: Palma de Mallorca

Posts: 1,419

|

Quote: Quote:

Originally Posted by yakers

Since oil is pretty much priced in dollars it ought to make living in Europe and other places whose currency is improving cheaper places to live.

|

I suppose that it cushions the effects of commodity price rises somewhat, but in local terms we're paying 25% more for gas than 2 years ago, and that's with over half the price being a fixed amount per gallon of tax. Super-Premium gas is close to $10 a gallon in Germany right now.

|

|

|

05-03-2011, 12:28 PM

05-03-2011, 12:28 PM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Aug 2006

Posts: 12,483

|

Quote: Quote:

Originally Posted by MichaelB

True, but you still have accessible and affordable health care.

|

But austerity, at least in the UK..........

__________________

Consult with your own advisor or representative. My thoughts should not be construed as investment advice. Past performance is no guarantee of future results (love that one).......:)

This Thread is USELESS without pics.........:)

|

|

|

05-03-2011, 03:54 PM

05-03-2011, 03:54 PM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by BigNick

Super-Premium gas is close to $10 a gallon in Germany right now.

|

Does this price seem to be affecting miles driven very much?

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

05-04-2011, 05:14 AM

05-04-2011, 05:14 AM

|

#11

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2004

Posts: 1,558

|

@BigNick - yup - ouch is the word here in Deutschland, too. I saw $1.52 for a Euro - double ouch!!!!! Only good thing is my European customers pay in Euros.....

Gas is expensive in general in Europe....ugghhh....and public transit is getting any cheaper either. Only good thing I can think of is the pathways between towns and towns beign ~ 5m apart so walking locally is workable.

__________________

Deserat aka Bridget

“We sleep soundly in our beds because rough men stand ready in the night to visit violence on those who would do us harm.”

|

|

|

05-04-2011, 05:41 AM

05-04-2011, 05:41 AM

|

#12

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2010

Location: Palma de Mallorca

Posts: 1,419

|

Quote: Quote:

Originally Posted by haha

Does this price seem to be affecting miles driven very much?

|

I saw a couple of anecdotes about this from the UK, but I guess the answer will be in the volume of fuel sold, and I'm not sure if those figures are published. I do know that the media coverage tends to be "mentioned once a month, third item on the bulletin", perhaps when a politician makes a suggestion for tweaking the tax, rather than the wall-to-wall coverage which it gets in the US. When Obama released his birth certificate, the BBC's US correspondent went to a diner to ask people what they thought and he reported that most of them wanted to talk about the price of gas. (Any politician who proposed $6/gallon in Europe would gain several percentage points in the ratings!)

|

|

|

05-04-2011, 06:13 AM

05-04-2011, 06:13 AM

|

#13

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2010

Location: dubuque

Posts: 1,174

|

they should raise the interest rates and take the oil out of the hands of pension and hedge fund speculators. with interest rates so low funds can make a lot of money speculating on oil, while ruining the economy for others. oil should not be sold for speculation.

|

|

|

05-06-2011, 05:32 AM

05-06-2011, 05:32 AM

|

#14

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,699

|

Hey BigNick, the euro is halfway back. Feeling any better?

__________________

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.”

― Rudiger Dornbusch

|

|

|

05-06-2011, 06:21 AM

05-06-2011, 06:21 AM

|

#15

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Lots of talk again about a "plunging dollar." Ranks up there with inflation fears that never seem to materialize.

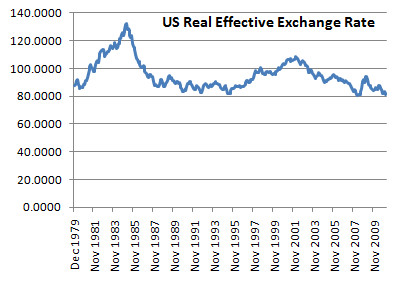

So let's look at the dollar exchange rate over time.

This graph makes me think three things 1) Exchange rates have moved sideways within a wide band for the last 30 years. 2) I don't recall anyone worrying about a collapse in the dollar between 2001 and 2007 when the slide was far larger than today's. 3) The biggest period of dollar decline (from 1984 to 1987) also corresponded to the years of greatest economic growth.

__________________

Retired early, traveling perpetually.

|

|

|

05-06-2011, 07:40 AM

05-06-2011, 07:40 AM

|

#16

|

|

Full time employment: Posting here.

Join Date: Apr 2011

Posts: 625

|

Quote: Quote:

|

Originally Posted by Gone4Good

Lots of talk again about a "plunging dollar." Ranks up there with inflation fears that never seem to materialize.

So let's look at the dollar exchange rate over time.

This graph makes me think three things 1) Exchange rates have moved sideways within a wide band for the last 30 years. 2) I don't recall anyone worrying about a collapse in the dollar between 2001 and 2007 when the slide was far larger than today's. 3) The biggest period of dollar decline (from 1984 to 1987) also corresponded to the years of greatest economic growth.

|

I think fears have less to do with exchange rates and more to do with the amount of money we're printing (not literally, but on paper) and the growing amount of national debt.

|

|

|

07-04-2011, 01:52 PM

07-04-2011, 01:52 PM

|

#17

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2010

Location: Palma de Mallorca

Posts: 1,419

|

I just ran the numbers from last July, when if you recall we had a pretty nice market run-up. Since then, excluding new money, I'm up 3.06% in Euros and 15.7% in USD.

|

|

|

07-11-2011, 04:21 PM

07-11-2011, 04:21 PM

|

#18

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2006

Posts: 7,733

|

Quote: Quote:

Originally Posted by BigNick

I just ran the numbers from last July, when if you recall we had a pretty nice market run-up. Since then, excluding new money, I'm up 3.06% in Euros and 15.7% in USD.

|

Hard to figure out which currency is in worse shape. The dollar with massive deficits and debt and a coming debt crisis. Or the Euro with all of the smaller economy, Ireland, Greece, Spain, Portugal, and I guess now Italy being under stress.

I am thinking the Swiss Franc is looking better and better, along with a smattering of the Brazilian Real, and Chinese Yuan.

|

|

|

07-11-2011, 10:14 PM

07-11-2011, 10:14 PM

|

#19

|

|

Full time employment: Posting here.

Join Date: Apr 2011

Posts: 625

|

Quote: Quote:

|

Originally Posted by clifp

Hard to figure out which currency is in worse shape. The dollar with massive deficits and debt and a coming debt crisis. Or the Euro with all of the smaller economy, Ireland, Greece, Spain, Portugal, and I guess now Italy being under stress.

I am thinking the Swiss Franc is looking better and better, along with a smattering of the Brazilian Real, and Chinese Yuan.

|

Yeah but then you have the inflation China is potentially facing and the potential collapse of their housing market. I don't know that anyone has a real good idea where any of it is heading, definitely not in the short term.

|

|

|

01-08-2015, 01:03 PM

01-08-2015, 01:03 PM

|

#20

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Aug 2011

Location: West of the Mississippi

Posts: 17,251

|

Quote: Quote:

Originally Posted by obgyn65

I would not be surprised if 1 euro = $2 by 2015.

|

Well......... Looks like I am not the only one whose predictions are not the best.

Last I checked a Euro was worth about $1.19.

__________________

Comparison is the thief of joy

The worst decisions are usually made in times of anger and impatience.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|