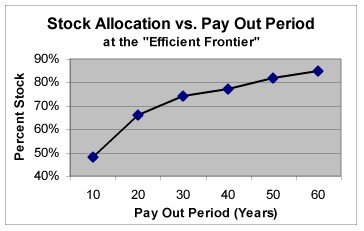

I know that an investor's stock/bond allocation depends, in part, on his/her personal investment style, age, risk tolerance, etc. However, is there an "ideal" percent allocation between stocks and bonds- a mix that generates the highest rate of return with the lowest amount of risk?

I thought I read a research paper that suggested a 50%/50% allocation between stocks and bonds was the "sweet spot" for maximizing return while minimizing risk, but I can't find it now.

I appreciate your thoughts on this issue.

I thought I read a research paper that suggested a 50%/50% allocation between stocks and bonds was the "sweet spot" for maximizing return while minimizing risk, but I can't find it now.

I appreciate your thoughts on this issue.