Yes this market can be a bit depressing. As of today, my portfolio is down 4.1% YTD, not the end of the world... yet. My net worth is still up 4.2% YTD so at least there is some positive news. So far I have no plan to make any change to my portfolio. I will continue to DCA/VCA into my accounts as usual. In the meantime, I'll take comfort in watching my bear market fund tame my portfolio's volatility and cushion the fall.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market Seems to Be Taking A Dive While ER.ORG Has Been On Other Assignments

- Thread starter haha

- Start date

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Market down another 200 plus points again today. Another great buying opportunity for somebody!

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Market down another 200 plus points again today. Another great buying opportunity for somebody!

Why aren't you out playing golf instead of making yourself miserable watching the market tank?

Then again, your strategy may be that if you keep stressing over this you'll be dead long before running out of money and having to go back to w*rk. You crafty old Dawg...

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why aren't you out playing golf instead of making yourself miserable watching the market tank?

Then again, your strategy may be that if you keep stressing over this you'll be dead long before running out of money and having to go back to w*rk. You crafty old Dawg...

I usually take Thursday off. Took the mutt swimming this morning.

To think the DOW was at 13k around May 19 and now it's down almost 1500 points in a month. If that doesn't frost your %$#! I don't know what does. Your right, the market makes me miserable. That's why I'm going to be out(well cut way back) if it ever gets back to what it was just a frigging month ago.

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

The majority of my clients are down 3-4%, while the indexes are down 10%. And they are NOT selling, I had 5 guys buy heavy today alone...........

Maybe brewer's hedge fund is knocking the cover off the ball

Maybe brewer's hedge fund is knocking the cover off the ball

ziggy29

Moderator Emeritus

I'm down about 5.5% YTD including today's carnage. It helps to have about 30% out of stocks and about 10% of my equity position in GDX today.The majority of my clients are down 3-4%, while the indexes are down 10%. And they are NOT selling, I had 5 guys buy heavy today alone...........

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Dude, are you offering group discounts?The majority of my clients are down 3-4%, while the indexes are down 10%.

That March low I mentioned in the OP post was cut without much sawing.

Ha

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

Dude, are you offering group discounts?

No, I am expected to offer sound advice for free on this forum.......

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

To think the DOW was at 13k around May 19 and now it's down almost 1500 points in a month. If that doesn't frost your %$#! I don't know what does. Your right, the market makes me miserable. That's why I'm going to be out(well cut way back) if it ever gets back to what it was just a frigging month ago.

As an early retiree with no pension and too young for SS (just barely), I can't say I'm particularly enjoying what the marked is doing. However, having watched the market oscillate down and up for more than 40 years I've learned not to fret too much when it tanks. I will also admit to taking some comfort from the fact I have a couple of years living expenses in cash, 40% of my portfolio in bonds and am less than a year from starting to collect from all the nice people who are still working to fund my SS benefits.

Not much gloom and doom around here, at least not yet.

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm down about 5.5% YTD including today's carnage. It helps to have about 30% out of stocks and about 10% of my equity position in GDX today.

Roughly the same for me, DJP and my natural resource fund has helped me to some extent.

No, I am expected to offer sound advice for free on this forum.......That being said, I have been reminded over and over again by a fair number on here how "guys like me" are unnecessary, inexperienced, and of no value............

Well, the problem is Ameriprise. That was my first, and, to-date only run-in with an FA. We've interviewed one other one since then, but couldn't get past his fee structure at that point (again, blame it on Ameriprise). Then I've got a friend who is friends with an FA. We've talked to him, he seems rather knowledgable and ethical. However, before we can do anything, he wants to charge us to put together a big, glossy plan. I don't know where I'll be next year much less in 5, 10 or 15 years, so it seemed like a waste of $3k.

Maybe I'll tell my wife I found a nice guy on the Internet to help O0. We live within a day's drive after all.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No, I am expected to offer sound advice for free on this forum.......That being said, I have been reminded over and over again by a fair number on here how "guys like me" are unnecessary, inexperienced, and of no value............

Oh heck, it sounds like Dude is feeling unloved. Everyone, let's give it up for the Dude! (Sounds of clapping and cheering are heard.)

You are helpful you sweet person, and we should say so more often.

Ha

bbbamI

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

A flower for FDude.....@->->->----

Moemg

Gone but not forgotten

Dude ,you are the best !

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Moemg, FD is going to be upset that you ratted out his new client development strategy...

CuppaJoe

Moderator Emeritus

.... And they are NOT selling, I had 5 guys buy heavy today alone...........

I chunked the last of my new Keogh money in just before you posted this. Wow, that was fun! I felt like I was riding shotgun with a reckless driver on the road down to Muir Woods (hairpin turns and steep drop offs). This isn't gloating, I also chunked a bigger amount in on June 4. That's entertainment! Still have some more new money to play with. Remember, "It's only money." Will I need stitches for the knife wounds on my hands?

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

Well, the problem is Ameriprise. That was my first, and, to-date only run-in with an FA. We've interviewed one other one since then, but couldn't get past his fee structure at that point (again, blame it on Ameriprise). Then I've got a friend who is friends with an FA. We've talked to him, he seems rather knowledgable and ethical. However, before we can do anything, he wants to charge us to put together a big, glossy plan. I don't know where I'll be next year much less in 5, 10 or 15 years, so it seemed like a waste of $3k.

I had my own "run-in" with Ameriprise before it was Ameriprise. DW's grandfather left her some money that was with American Express. When we moved away, it took 2 months to transfer the account to the rep where we are now.

He wanted to do a plan and charge us $1200 for it, that was 1995. When I asked him how he justified charging us to do ANOTHER financial plan when my DW had one down just 18 months earlier, he gave me some BS about needing to "make different assumptions", etc. I told him no thanks on the "plan." He then agreed to do the "plan" for $200, and give us his recommendations. I balked but DW told him that was ok..........

"So, you get folks to purchase a "plan" from you, and then you invest them in propreitary products with loads? Isn't that getting paid twice? He hemmed and hawed, and we ended up leaving, and I took over investing the account. So, not a lot different from the experiences I read on here...........

Moemg

Gone but not forgotten

" Will I need stitches for the knife wounds on my hands?

Depends on how far you slice !

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sounds a bit like getting even and getting out. Not a good prescription for long term success. What about all those charts you see when running FIRECalc? Some of them go down for awhile before going back up. Bear markets are like this -- 2 steps down and 1 step up. You just have to hold on until the Bull market -- 1 step down and 2 steps up....To think the DOW was at 13k around May 19 and now it's down almost 1500 points in a month. If that doesn't frost your %$#! I don't know what does. Your right, the market makes me miserable. That's why I'm going to be out(well cut way back) if it ever gets back to what it was just a frigging month ago.

But I know how you feel

HFWR

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

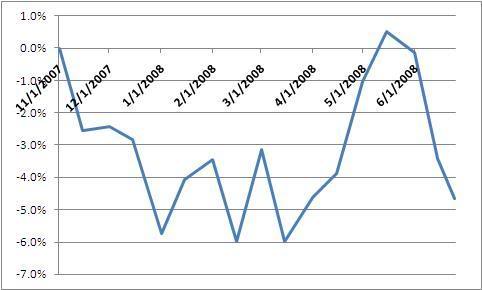

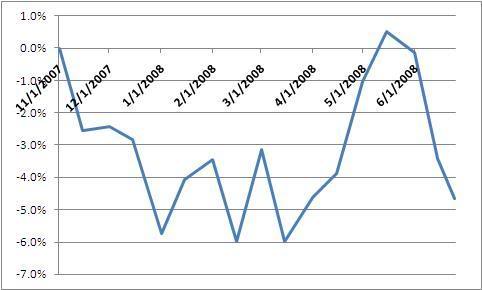

This is a return chart, since 11/1/2007, for my 401k portfolio, with a value snapshot taken semi-monthly. Granted, it doesn't necessarily capture all the highs and lows, but gives a good trend line...

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sounds a bit like getting even and getting out. Not a good prescription for long term success. What about all those charts you see when running FIRECalc? Some of them go down for awhile before going back up. Bear markets are like this -- 2 steps down and 1 step up. You just have to hold on until the Bull market -- 1 step down and 2 steps up.

Yep, that's all I want at this point. To get even. I'm not sure I will live long enough to see the "1 step down and 2 steps up" you describe. What's the disclaimer published at the end of all mutual fund prospectus? 'Past performance is no guarantee of future results'?

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My friend (I'm trying out the politician's tacticYep, that's all I want at this point. To get even. I'm not sure I will live long enough to see the "1 step down and 2 steps up" you describe. What's the disclaimer published at the end of all mutual fund prospectus? 'Past performance is no guarantee of future results'?

), I can promise you that you will live to see the next bull market. If I'm wrong I'll meet you in ...ummm ... the appropriate place

), I can promise you that you will live to see the next bull market. If I'm wrong I'll meet you in ...ummm ... the appropriate place  .

.Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My friend (I'm trying out the politician's tactic), I can promise you that you will live to see the next bull market. If I'm wrong I'll meet you in ...ummm ... the appropriate place

.

See ya there.

clifp

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 27, 2006

- Messages

- 7,733

No, I am expected to offer sound advice for free on this forum.......That being said, I have been reminded over and over again by a fair number on here how "guys like me" are unnecessary, inexperienced, and of no value............

We in turn provide you with free lessons on humility, it seems like a fair deal

We've offered the same deal to Brewer but he seems to be a bit of a slow learner in the humility department.

Similar threads

- Replies

- 144

- Views

- 8K