dex

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 28, 2003

- Messages

- 5,105

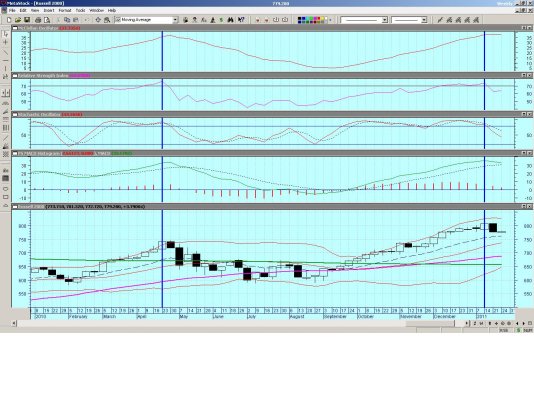

These charts are of the Russell 2000, the index that led the market up.

It is looking a lot like April.

Anyone lightening up on stocks?

First is the daily

Second is the weekly

Take a look at the heavy vertical blue lines.

Also, it has started to bounce along the lower bollenger band on the daily.

Don't put too much weight on the January Barometer.

http://seekingalpha.com/article/114581-how-accurate-is-the-january-barometer

It is looking a lot like April.

Anyone lightening up on stocks?

First is the daily

Second is the weekly

Take a look at the heavy vertical blue lines.

Also, it has started to bounce along the lower bollenger band on the daily.

Don't put too much weight on the January Barometer.

http://seekingalpha.com/article/114581-how-accurate-is-the-january-barometer