dory36

Early-Retirement.org Founder, Developer of FIRECal

- Joined

- Jun 23, 2002

- Messages

- 1,841

Re: SWR, terminal values, TIPS, I-bnds & comm pape

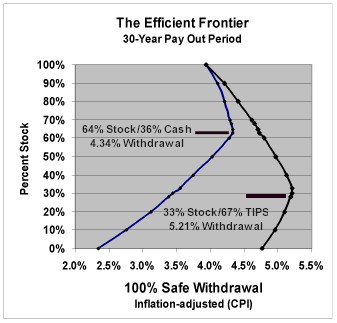

All in all, the research on asset allocation and the "efficient frontier" pretty much addresses all this stuff, doesn't it?

Here's the graph from the REHP:

When Intercst published this about 4 years ago, many of us ran to our SWR calculators and found that these allocation mixes were, in fact, the best over the historical periods we have been looking at.

Dory36

Well, it doesn't seem quite right to me, but I may be all wet.Dory's analogy about umbrella's and rain buckets to explain the difference between SWR and average terminal value simulation made me think a little (and that's a good thing). But after some thought I'm convinced the argument doesn't hold water.Sorry, I just had to find a way to put that stupid pun in this post.

All in all, the research on asset allocation and the "efficient frontier" pretty much addresses all this stuff, doesn't it?

Here's the graph from the REHP:

When Intercst published this about 4 years ago, many of us ran to our SWR calculators and found that these allocation mixes were, in fact, the best over the historical periods we have been looking at.

Dory36