Wow. Taleb's long on analogies and slogans but very short on any real analysis. It's hard to evaluate a critique of monetary policy that begins and ends with a comparison to pouring ketchup from a bottle. Nowhere did he explain why it should work that way (what's keeping inflation low currently, what will change to make it accelerate, does he even know, does he even care?). The entire interview is like that.

QUOTE]

+1

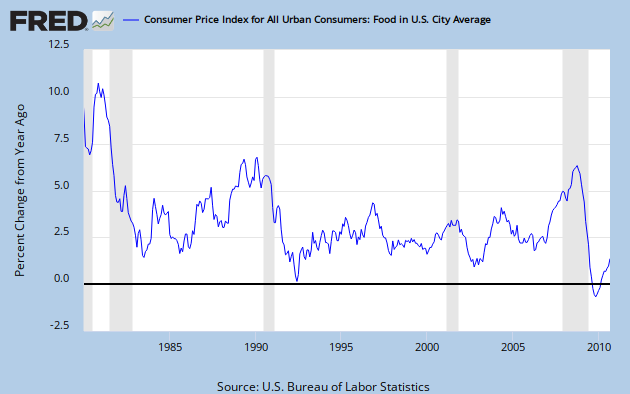

As a side point, we already have inflation in many parts of the world. Australia is experiencing rising inflation (in spite of its strong AUD), China's most recent inflation number was 4.4%, Hong Kong's 3.7% etc. Globally, inflation is not "low". It's showing up noticably in our grocery bills (especially meat and fresh vegetables).