TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

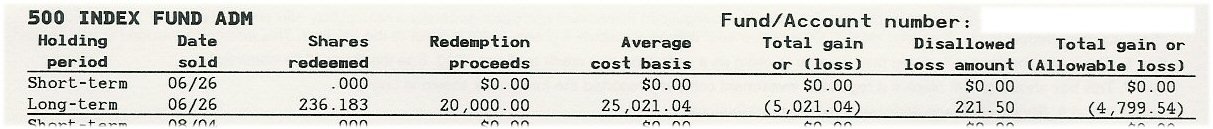

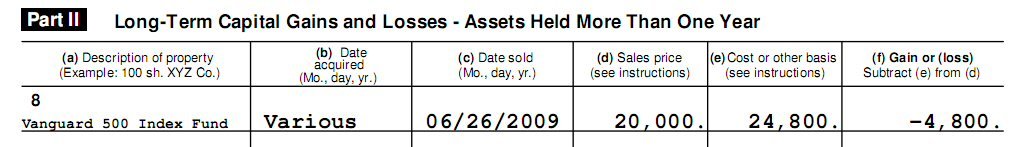

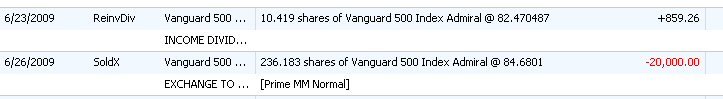

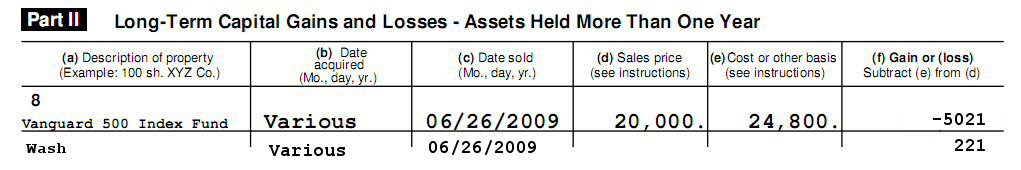

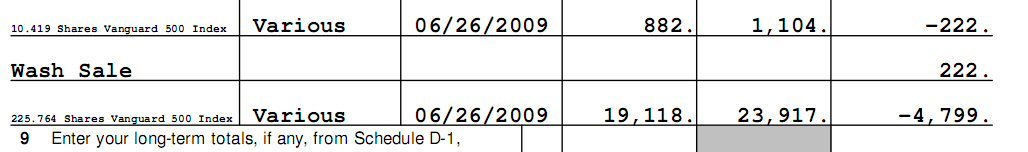

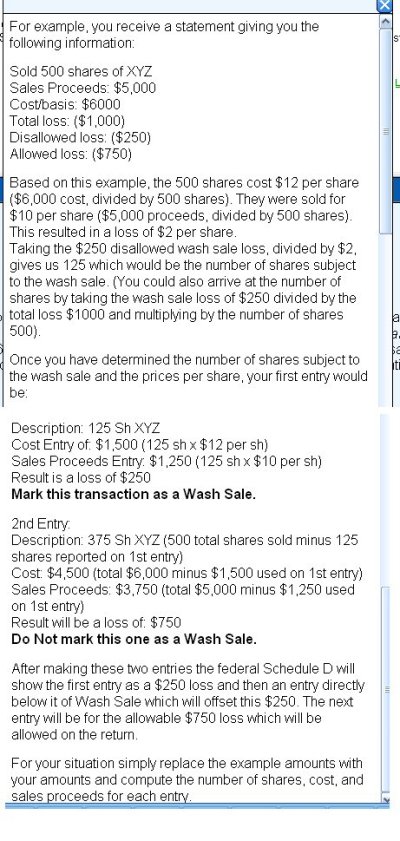

Last June I transferred $20,000 from the VG 500 index fund to the money market. The cost basis for those shares was $25,021.04, but the Average Cost summary that I got from VG shows a Disallowed Loss Amount of $221.50.

Question 1: why would that be disallowed? I didn't put any money into that account in 2009.

Question 2: TaxAct asks only for sales proceeds and cost basis. Do I put in $24,799.54 for the cost basis?

Thanks.

Question 1: why would that be disallowed? I didn't put any money into that account in 2009.

Question 2: TaxAct asks only for sales proceeds and cost basis. Do I put in $24,799.54 for the cost basis?

Thanks.