TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

Use this thread to note things you liked or didn't like about TaxAct. Others can take note to help decide which tax app to use. Maybe someone else can start a thread for other tax return apps.

Or you can just use it to vent your frustration.

My gripes so far:

1. Because I used the online version last year, and the download version this year, it couldn't just suck up my info from last year. Would that have been so hard for the app to do? It looked at the PDF from last year, but didn't get much.

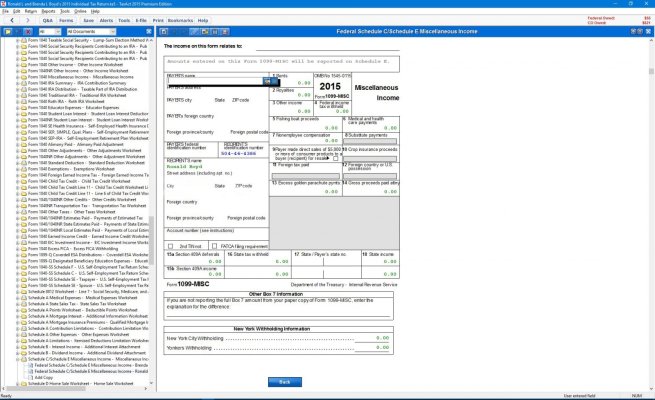

2. When entering info on forms, the window is not resizable, so, despite having a large monitor, I must work in a tiny window and scroll around.

3. There is no OK button in the form window. The windows standard is that closing a window with the x is equivalent to clicking Cancel.

Or you can just use it to vent your frustration.

My gripes so far:

1. Because I used the online version last year, and the download version this year, it couldn't just suck up my info from last year. Would that have been so hard for the app to do? It looked at the PDF from last year, but didn't get much.

2. When entering info on forms, the window is not resizable, so, despite having a large monitor, I must work in a tiny window and scroll around.

3. There is no OK button in the form window. The windows standard is that closing a window with the x is equivalent to clicking Cancel.